Summary

This paper relies on a microsimulation framework to undertake an analysis of the distributional implications of the COVID-19 crisis over three waves. Given the lack of real-time survey data during the fast moving crisis, it applies a nowcasting methodology and real-time aggregate administrative data to calibrate an income survey and to simulate changes in the tax benefit system that attempted to mitigate the impacts of the crisis. Our analysis shows how crisis-induced income-support policy innovations combined with existing progressive elements of the tax-benefit system were effective in avoiding an increase in income inequality at all stages of waves 1-3 of the COVID-19 emergency in Ireland. There was, however, a decline in generosity over time as benefits became more targeted. On a methodological level, our paper makes a specific contribution in relation to the choice of welfare measure in assessing the impact of the COVID-19 crisis on inequality.

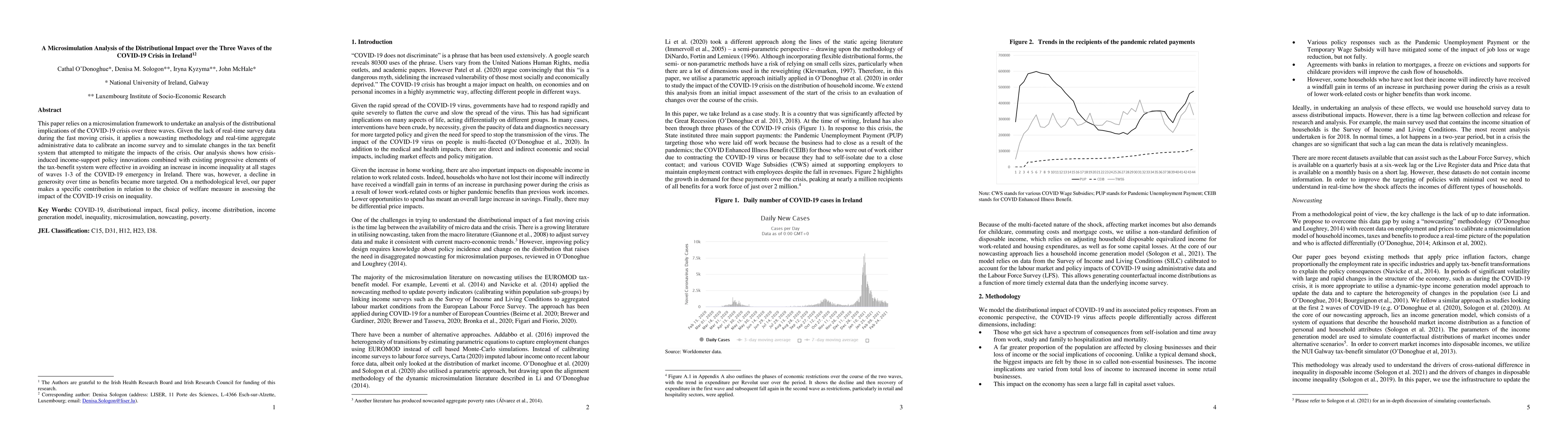

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersPoverty during Covid-19 in North Macedonia: Analysis of the distributional impact of the crisis and government response

Marjan Petreski

The Learning Crisis: Three Years After COVID-19

Tomasz Gajderowicz, Maciej Jakubowski, Alec Kennedy et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)