Summary

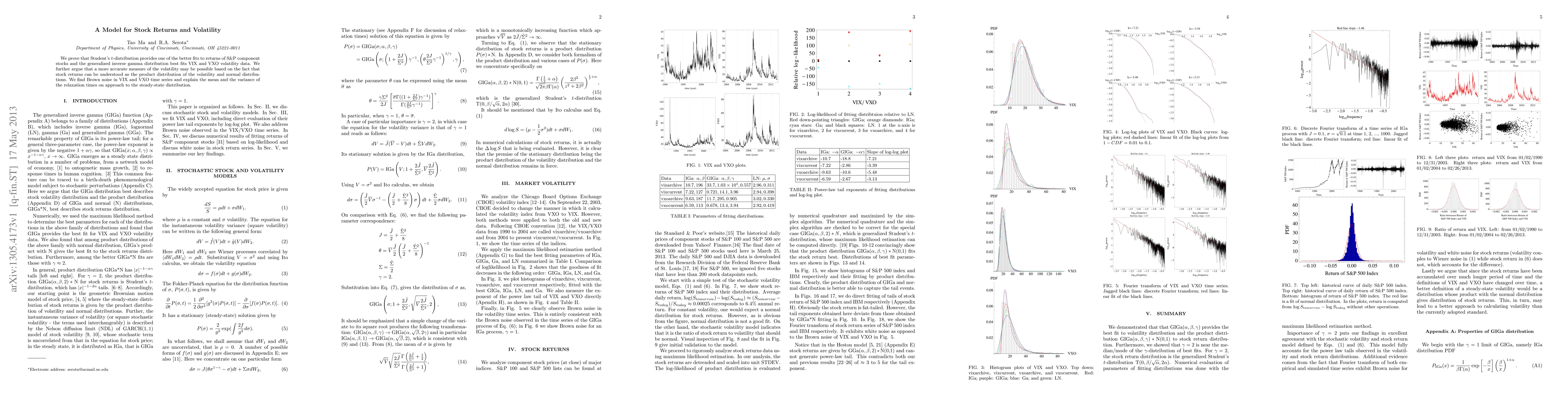

We prove that Student's t-distribution provides one of the better fits to returns of S&P component stocks and the generalized inverse gamma distribution best fits VIX and VXO volatility data. We further argue that a more accurate measure of the volatility may be possible based on the fact that stock returns can be understood as the product distribution of the volatility and normal distributions. We find Brown noise in VIX and VXO time series and explain the mean and the variance of the relaxation times on approach to the steady-state distribution.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersLiquidity Costs, Idiosyncratic Volatility and Expected Stock Returns

M. Reza Bradrania, Maurice Peat, Stephen Satchell

| Title | Authors | Year | Actions |

|---|

Comments (0)