Summary

We derive a backward and forward nonlinear PDEs that govern the implied volatility of a contingent claim whenever the latter is well-defined. This would include at least any contingent claim written on a positive stock price whose payoff at a possibly random time is convex. We also discuss suitable initial and boundary conditions for those PDEs. Finally, we demonstrate how to solve them numerically by using an iterative finite-difference approach.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

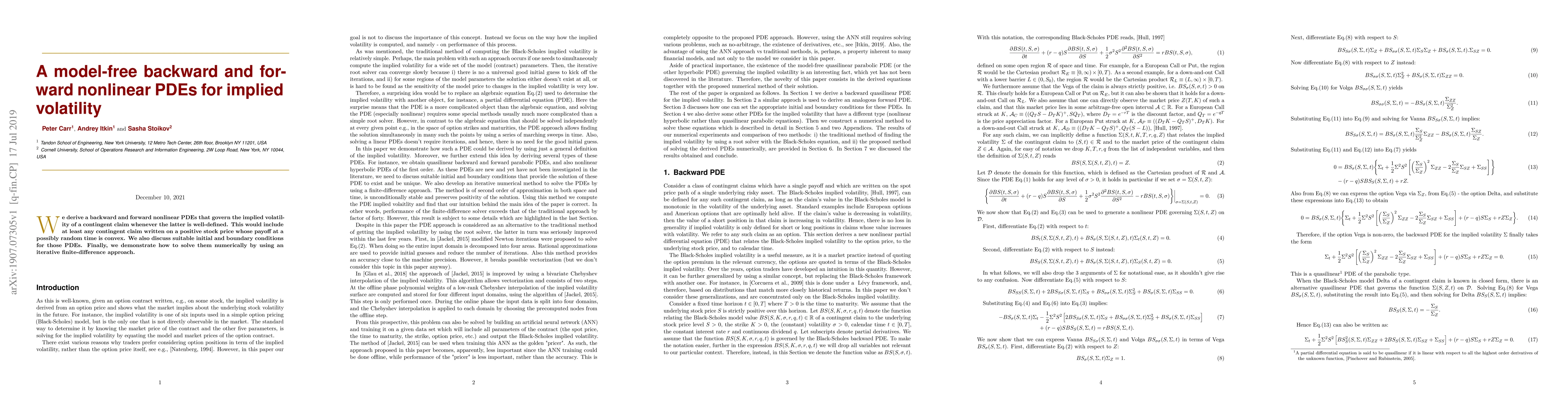

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersImplied volatility (also) is path-dependent

Hervé Andrès, Alexandre Boumezoued, Benjamin Jourdain

| Title | Authors | Year | Actions |

|---|

Comments (0)