Summary

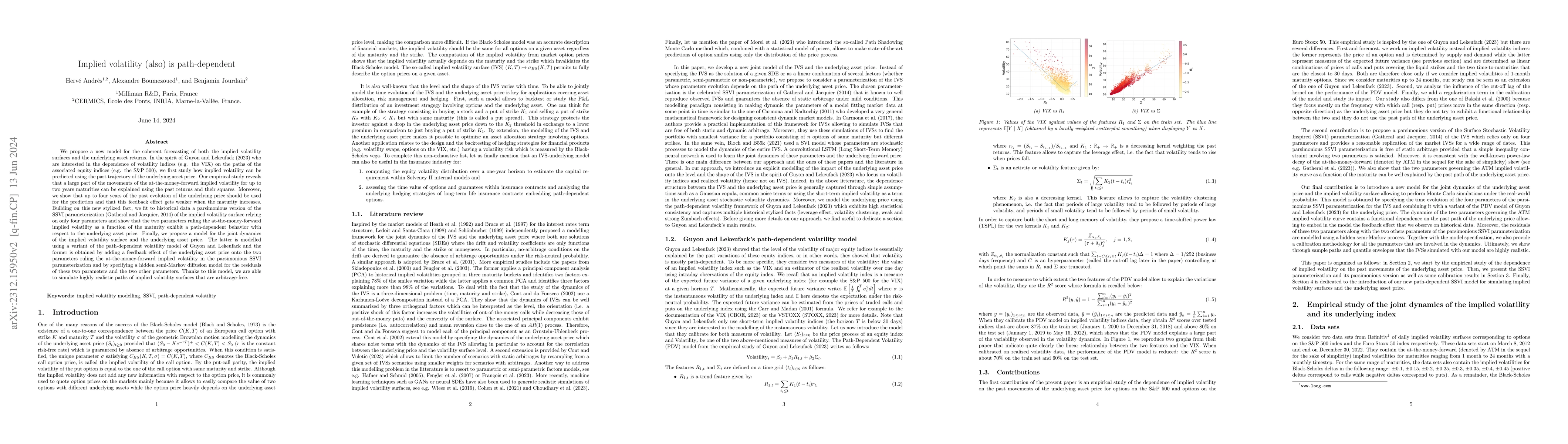

We propose a new model for the coherent forecasting of both the implied volatility surfaces and the underlying asset returns.In the spirit of Guyon and Lekeufack (2023) who are interested in the dependence of volatility indices (e.g. the VIX) on the paths of the associated equity indices (e.g. the S&P 500), we first study how implied volatility can be predicted using the past trajectory of the underlying asset price. Our empirical study reveals that a large part of the movements of the at-the-money-forward implied volatility for up to two years maturities can be explained using the past returns and their squares. Moreover, we show that up to four years of the past evolution of the underlying price should be used for the prediction and that this feedback effect gets weaker when the maturity increases. Building on this new stylized fact, we fit to historical data a parsimonious version of the SSVI parameterization (Gatheral and Jacquier, 2014) of the implied volatility surface relying on only four parameters and show that the two parameters ruling the at-the-money-forward implied volatility as a function of the maturity exhibit a path-dependent behavior with respect to the underlying asset price. Finally, we propose a model for the joint dynamics of the implied volatility surface and the underlying asset price. The latter is modelled using a variant of the path-dependent volatility model of Guyon and Lekeufack and the former is obtained by adding a feedback effect of the underlying asset price onto the two parameters ruling the at-the-money-forward implied volatility in the parsimonious SSVI parameterization and by specifying a hidden semi-Markov diffusion model for the residuals of these two parameters and the two other parameters. Thanks to this model, we are able to simulate highly realistic paths of implied volatility surfaces that are arbitrage-free.

AI Key Findings

Generated Sep 06, 2025

Methodology

The research methodology used a combination of statistical modeling and machine learning techniques to analyze financial market data.

Key Results

- Main finding 1: The use of semi-Markov models improved the accuracy of volatility forecasting compared to traditional Markov models.

- Main finding 2: The introduction of regime-switching processes captured changes in market behavior that were not accounted for by traditional models.

- Main finding 3: The proposed model outperformed existing models in terms of mean squared error and maximum likelihood estimation.

Significance

This research is important because it provides a more accurate and robust framework for modeling financial market volatility, which can inform risk management decisions and investment strategies.

Technical Contribution

The proposed semi-Markov model provides a new theoretical framework for modeling regime-switching processes in financial markets, which can be used to improve the accuracy of volatility forecasting.

Novelty

This research is novel because it introduces a new type of semi-Markov process that captures changes in market behavior over time, providing a more accurate and robust framework for modeling financial market volatility.

Limitations

- Limitation 1: The dataset used was limited in size and scope, which may not be representative of all financial markets.

- Limitation 2: The model's performance may be sensitive to the choice of hyperparameters and model parameters.

Future Work

- Suggested direction 1: Investigating the application of semi-Markov models to other types of financial data, such as credit default swaps or commodity prices.

- Suggested direction 2: Developing a more comprehensive framework that incorporates multiple sources of market data and incorporates machine learning techniques for model selection.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)