Benjamin Jourdain

21 papers on arXiv

Academic Profile

Statistics

Similar Authors

Papers on arXiv

Weak well-posedness and weak discretization error for stable-driven SDEs with Lebesgue drift

We are interested in the discretization of stable driven SDEs with additive noise for $\alpha$ $\in$ (1, 2) and Lq -- Lp drift under the Serrin type condition $\alpha$/q + d/p < $\alpha$ -- 1. We sh...

Implied volatility (also) is path-dependent

We propose a new model for the coherent forecasting of both the implied volatility surfaces and the underlying asset returns.In the spirit of Guyon and Lekeufack (2023) who are interested in the dep...

Convex ordering of solutions to one-dimensional SDEs

In this paper, we are interested in the propagation of convexity by the strong solution to a one-dimensional Brownian stochastic differential equation with coefficients Lipschitz in the spatial vari...

Maximal Martingale Wasserstein Inequality

In this note, we complete the analysis of the Martingale Wasserstein Inequality started in arXiv:2011.11599 by checking that this inequality fails in dimension $d\ge 2$ when the integrability parame...

Central limit theorem for the stratified resampling mechanism

The stratified resampling mechanism is one of the resampling schemes commonly used in the resampling steps of particle filters. In the present paper, we prove a central limit theorem for this mechan...

Convergence to the uniform distribution of vectors of partial sums modulo one with a common factor

In this work, we prove the joint convergence in distribution of $q$ variables modulo one obtained as partial sums of a sequence of i.i.d. square integrable random variables multiplied by a common fa...

Non-decreasing martingale couplings

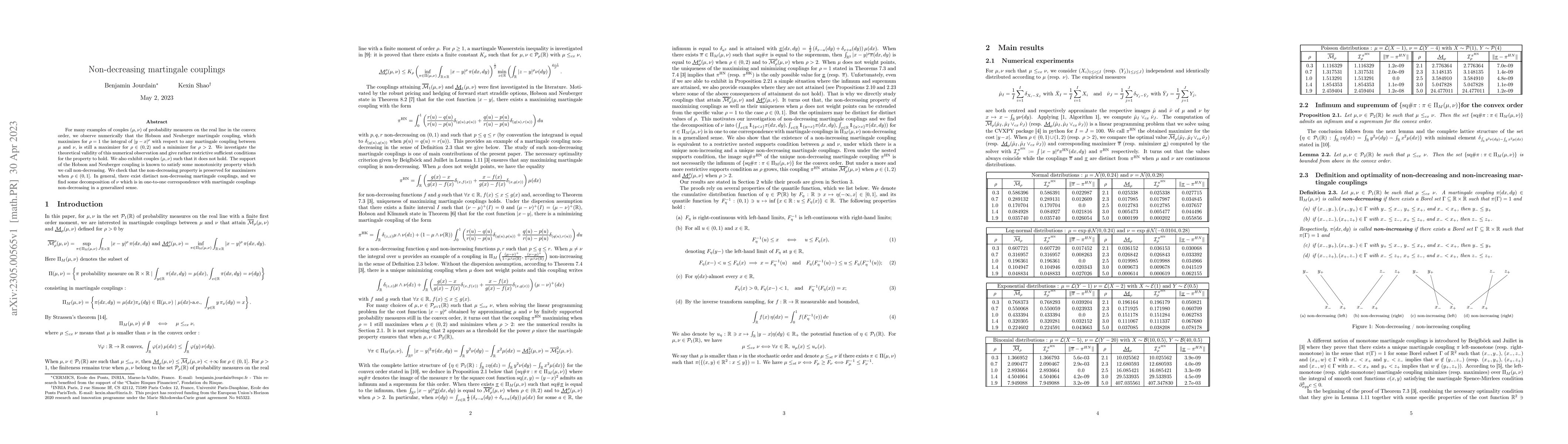

For many examples of couples $(\mu,\nu)$ of probability measures on the real line in the convex order, we observe numerically that the Hobson and Neuberger martingale coupling, which maximizes for $...

An extension of martingale transport and stability in robust finance

While many questions in robust finance can be posed in the martingale optimal transport framework or its weak extension, others like the subreplication price of VIX futures, the robust pricing of Am...

Convex ordering for stochastic Volterra equations and their Euler schemes

In this paper, we are interested in comparing solutions to stochastic Volterra equations for the convex order on the space of continuous $\R^d$-valued paths and for the monotonic convex order when $...

Lipschitz continuity of the Wasserstein projections in the convex order on the line

Wasserstein projections in the convex order were first considered in the framework of weak optimal transport, and found application in various problems such as concentration inequalities and marting...

Signature-based validation of real-world economic scenarios

Motivated by insurance applications, we propose a new approach for the validation of real-world economic scenarios. This approach is based on the statistical test developed by Chevyrev and Oberhause...

Central limit theorem over non-linear functionals of empirical measures: beyond the iid setting

The central limit theorem is, with the strong law of large numbers, one of the two fundamental limit theorems in probability theory. Benjamin Jourdain and Alvin Tse have extended to non-linear funct...

Stability of the Weak Martingale Optimal Transport Problem

While many questions in (robust) finance can be posed in the martingale optimal transport (MOT) framework, others require to consider also non-linear cost functionals. Following the terminology of G...

Approximation of martingale couplings on the line in the weak adapted topology

Our main result is to establish stability of martingale couplings: suppose that $\pi$ is a martingale coupling with marginals $\mu, \nu$. Then, given approximating marginal measures $\tilde \mu \app...

Central limit theorem over non-linear functionals of empirical measures with applications to the mean-field fluctuation of interacting particle systems

In this work, a generalised version of the central limit theorem is proposed for nonlinear functionals of the empirical measure of i.i.d. random variables, provided that the functional satisfies som...

Existence, uniqueness and positivity of solutions to the Guyon-Lekeufack path-dependent volatility model with general kernels

We show the existence and uniqueness of a continuous solution to a path-dependent volatility model introduced by Guyon and Lekeufack (2023) to model the price of an equity index and its spot volatilit...

Convex comparison of Gaussian mixtures

Motivated by the study of the propagation of convexity by semi-groups of stochastic differential equations and convex comparison between the distributions of solutions of two such equations, we study ...

On the Weak Error for Local Stochastic Volatility Models

Local stochastic volatility refers to a popular model class in applied mathematical finance that allows for "calibration-on-the-fly", typically via a particle method, derived from a formal McKean-Vlas...

Wasserstein projections in the convex order: regularity and characterization in the quadratic Gaussian case

In this paper, we first show continuity of both Wasserstein projections in the convex order when they are unique. We also check that, in arbitrary dimension $d$, the quadratic Wasserstein projection o...

Quadratic Wasserstein distance between Gaussian laws revisited with correlation

In this note, we give a simple derivation of the formula obtained in Dowson and Landau (1982), Olkin and Pukelsheim (1982) and Givens and Shortt (1984) for the quadratic Wasserstein distance between t...

On the surjectivity of the conditional expectation given a real random variable

In this paper, we investigate the distributions of random couples $(X,Y)$ with $X$ real-valued such that any non-negative integrable random variable $f(X)$ can be represented as a conditional expectat...