Summary

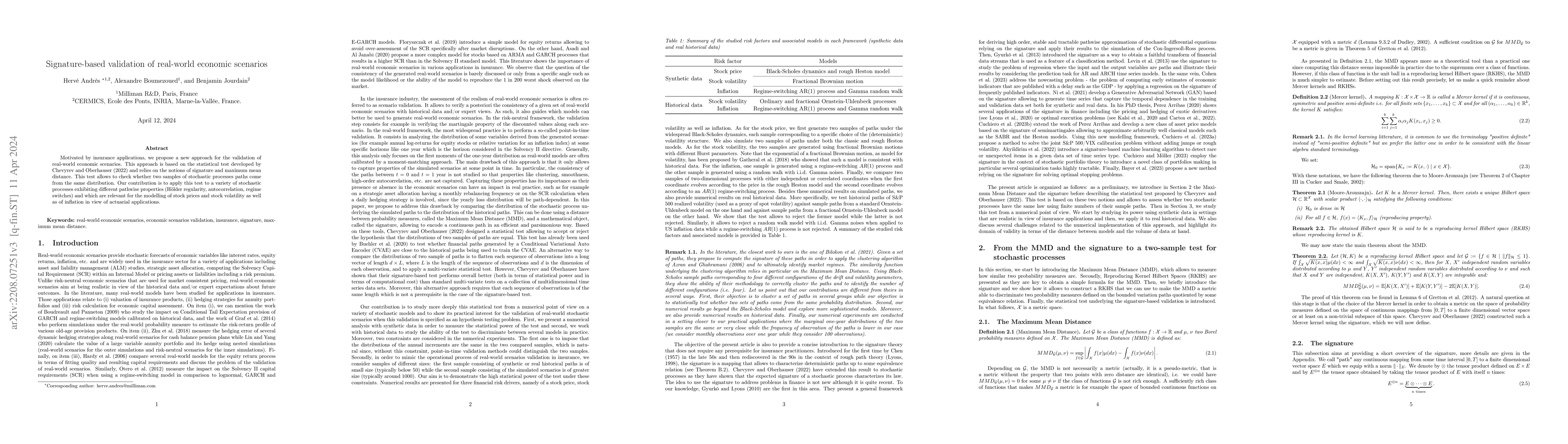

Motivated by insurance applications, we propose a new approach for the validation of real-world economic scenarios. This approach is based on the statistical test developed by Chevyrev and Oberhauser (2022) and relies on the notions of signature and maximum mean distance. This test allows to check whether two samples of stochastic processes paths come from the same distribution. Our contribution is to apply this test to a variety of stochastic processes exhibiting different pathwise properties (H{\"o}lder regularity, autocorrelation, regime switches) and which are relevant for the modelling of stock prices and stock volatility as well as of inflation in view of actuarial applications.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersParameterisation of lane-change scenarios from real-world data

Stewart Worrall, Eduardo Nebot, Julie Stephany Berrio et al.

Generalizing Event-Based Motion Deblurring in Real-World Scenarios

Xiang Zhang, Lei Yu, Jianzhuang Liu et al.

Towards Real-World Validation of a Physics-Based Ship Motion Prediction Model

Theodoros Stouraitis, Michail Mathioudakis, Christos Papandreou et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)