Authors

Summary

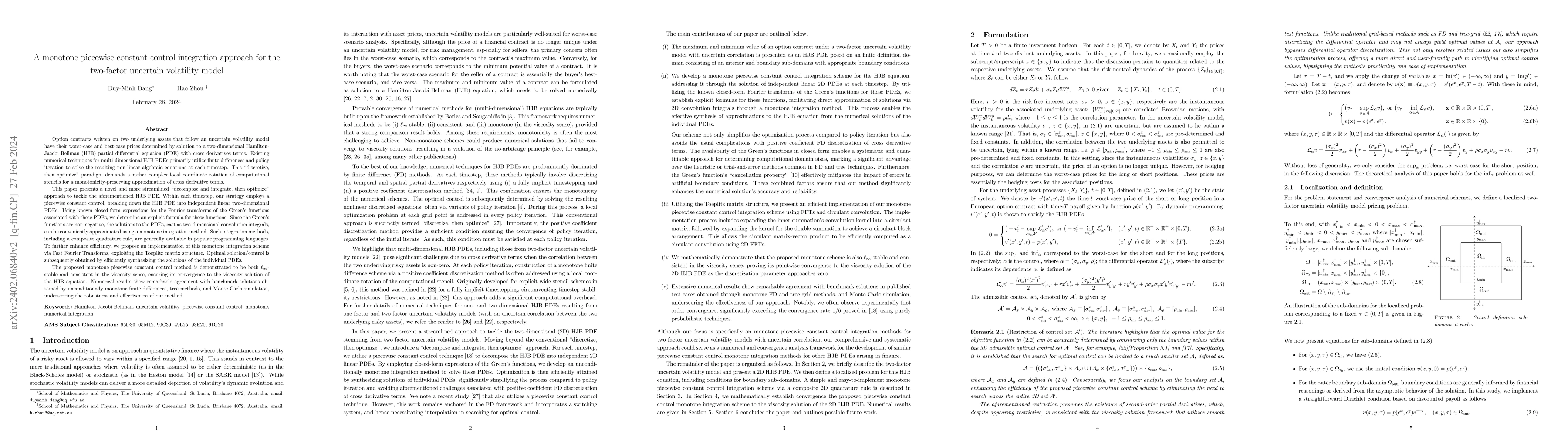

Prices of option contracts on two assets within uncertain volatility models for worst and best-case scenarios satisfy a two-dimensional Hamilton-Jacobi-Bellman (HJB) partial differential equation (PDE) with cross derivatives terms. Traditional methods mainly involve finite differences and policy iteration. This "discretize, then optimize" paradigm requires complex rotations of computational stencils for monotonicity. This paper presents a novel and more streamlined "decompose and integrate, then optimize" approach to tackle the aforementioned HJB PDE. Within each timestep, our strategy employs a piecewise constant control, breaking down the HJB PDE into independent linear two-dimensional PDEs. Using known closed-form expressions for the Fourier transforms of the Green's functions associated with these PDEs, we determine an explicit formula for these functions. Since the Green's functions are non-negative, the solutions to the PDEs, cast as two-dimensional convolution integrals, can be conveniently approximated using a monotone integration method. Such integration methods, including a composite quadrature rule, are generally available in popular programming languages. To further enhance efficiency, we propose an implementation of this monotone integration scheme via Fast Fourier Transforms, exploiting the Toeplitz matrix structure. Optimal control is subsequently obtained by efficiently synthesizing the solutions of the individual PDEs. The proposed monotone piecewise constant control method is demonstrated to be both $\ell_{\infty} $-stable and consistent in the viscosity sense, ensuring its convergence to the viscosity solution of the HJB equation. Numerical results show remarkable agreement with benchmark solutions obtained by unconditionally monotone finite differences, tree methods, and Monte Carlo simulation, underscoring the robustness and effectiveness of our method.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)