Summary

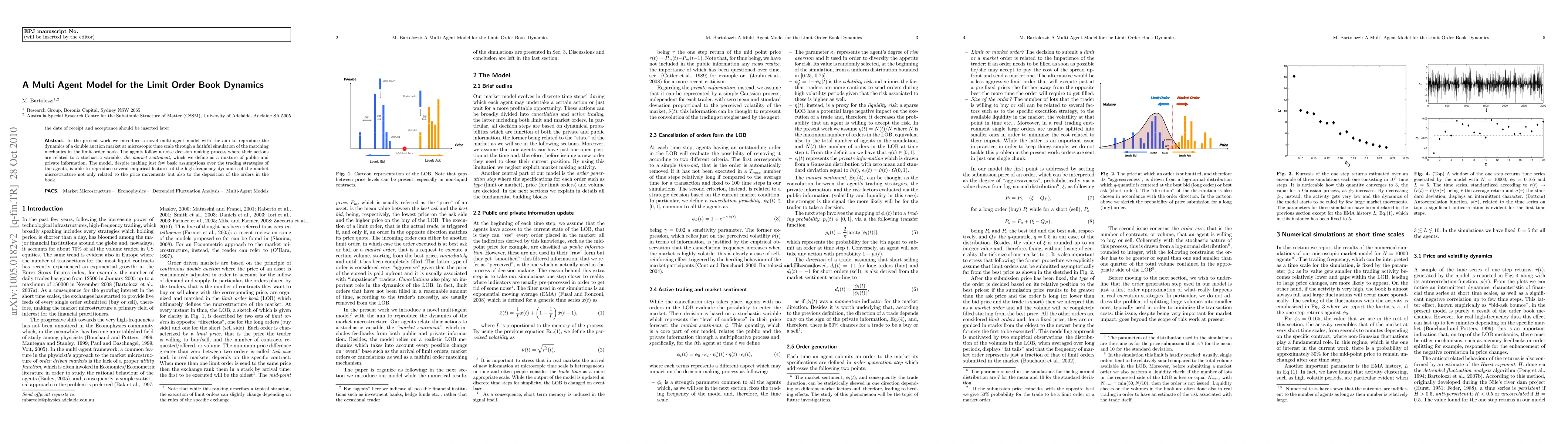

In the present work we introduce a novel multi-agent model with the aim to reproduce the dynamics of a double auction market at microscopic time scale through a faithful simulation of the matching mechanics in the limit order book. The agents follow a noise decision making process where their actions are related to a stochastic variable, "the market sentiment", which we define as a mixture of public and private information. The model, despite making just few basic assumptions over the trading strategies of the agents, is able to reproduce several empirical features of the high-frequency dynamics of the market microstructure not only related to the price movements but also to the deposition of the orders in the book.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)