Summary

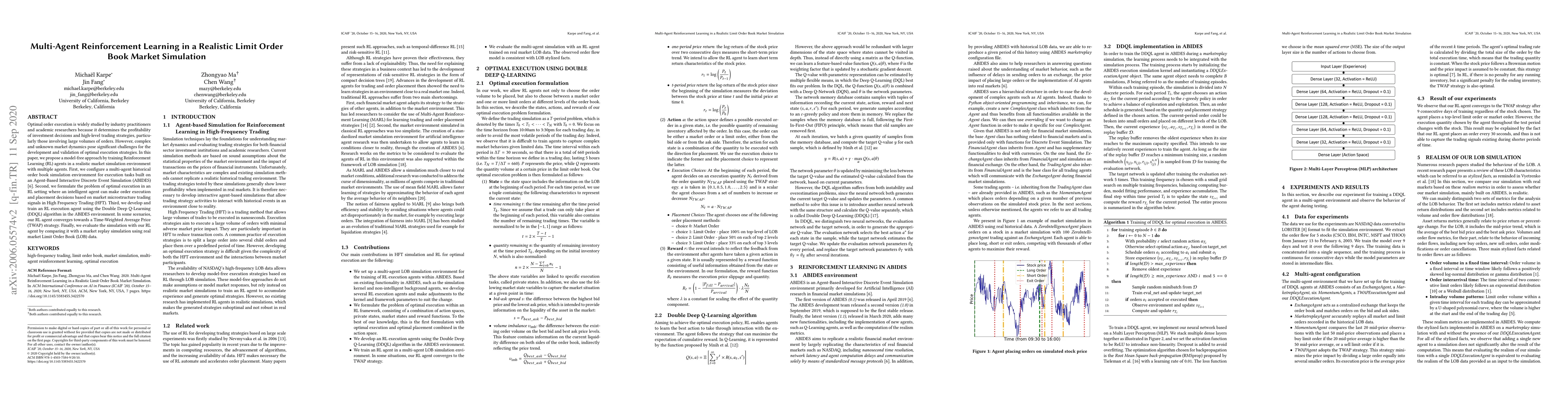

Optimal order execution is widely studied by industry practitioners and academic researchers because it determines the profitability of investment decisions and high-level trading strategies, particularly those involving large volumes of orders. However, complex and unknown market dynamics pose significant challenges for the development and validation of optimal execution strategies. In this paper, we propose a model-free approach by training Reinforcement Learning (RL) agents in a realistic market simulation environment with multiple agents. First, we configure a multi-agent historical order book simulation environment for execution tasks built on an Agent-Based Interactive Discrete Event Simulation (ABIDES) [arXiv:1904.12066]. Second, we formulate the problem of optimal execution in an RL setting where an intelligent agent can make order execution and placement decisions based on market microstructure trading signals in High Frequency Trading (HFT). Third, we develop and train an RL execution agent using the Double Deep Q-Learning (DDQL) algorithm in the ABIDES environment. In some scenarios, our RL agent converges towards a Time-Weighted Average Price (TWAP) strategy. Finally, we evaluate the simulation with our RL agent by comparing it with a market replay simulation using real market Limit Order Book (LOB) data.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOrder book regulatory impact on stock market quality: a multi-agent reinforcement learning perspective

Boris Gutkin, Johann Lussange

Deep Learning Meets Queue-Reactive: A Framework for Realistic Limit Order Book Simulation

Hamza Bodor, Laurent Carlier

Neural Stochastic Agent-Based Limit Order Book Simulation: A Hybrid Methodology

Zijian Shi, John Cartlidge

| Title | Authors | Year | Actions |

|---|

Comments (0)