Authors

Summary

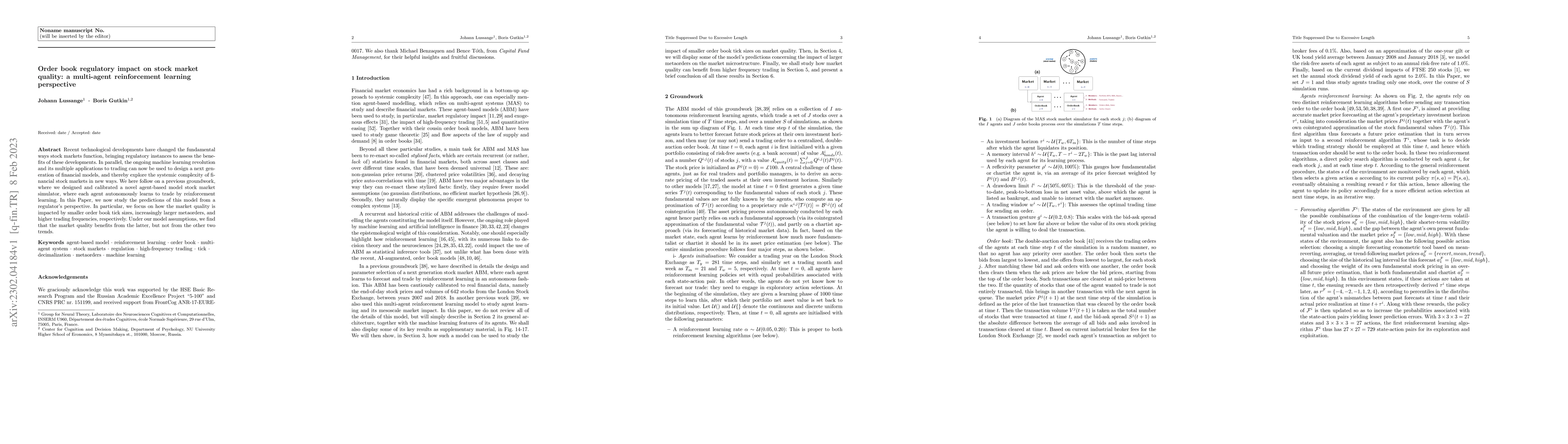

Recent technological developments have changed the fundamental ways stock markets function, bringing regulatory instances to assess the benefits of these developments. In parallel, the ongoing machine learning revolution and its multiple applications to trading can now be used to design a next generation of financial models, and thereby explore the systemic complexity of financial stock markets in new ways. We here follow on a previous groundwork, where we designed and calibrated a novel agent-based model stock market simulator, where each agent autonomously learns to trade by reinforcement learning. In this Paper, we now study the predictions of this model from a regulator's perspective. In particular, we focus on how the market quality is impacted by smaller order book tick sizes, increasingly larger metaorders, and higher trading frequencies, respectively. Under our model assumptions, we find that the market quality benefits from the latter, but not from the other two trends.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)