Authors

Summary

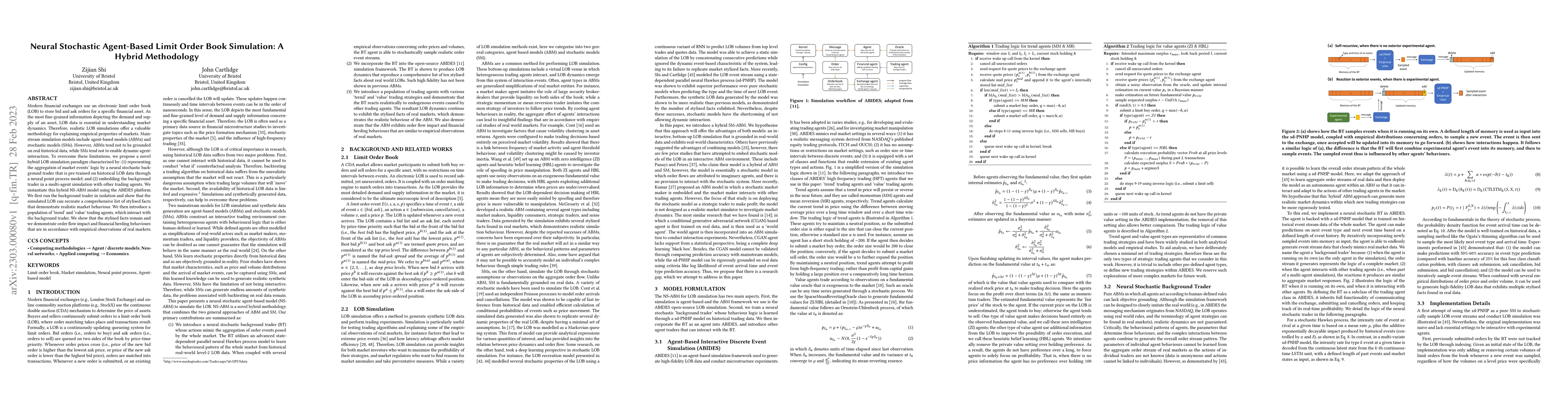

Modern financial exchanges use an electronic limit order book (LOB) to store bid and ask orders for a specific financial asset. As the most fine-grained information depicting the demand and supply of an asset, LOB data is essential in understanding market dynamics. Therefore, realistic LOB simulations offer a valuable methodology for explaining empirical properties of markets. Mainstream simulation models include agent-based models (ABMs) and stochastic models (SMs). However, ABMs tend not to be grounded on real historical data, while SMs tend not to enable dynamic agent-interaction. To overcome these limitations, we propose a novel hybrid LOB simulation paradigm characterised by: (1) representing the aggregation of market events' logic by a neural stochastic background trader that is pre-trained on historical LOB data through a neural point process model; and (2) embedding the background trader in a multi-agent simulation with other trading agents. We instantiate this hybrid NS-ABM model using the ABIDES platform. We first run the background trader in isolation and show that the simulated LOB can recreate a comprehensive list of stylised facts that demonstrate realistic market behaviour. We then introduce a population of `trend' and `value' trading agents, which interact with the background trader. We show that the stylised facts remain and we demonstrate order flow impact and financial herding behaviours that are in accordance with empirical observations of real markets.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersEvent-Based Limit Order Book Simulation under a Neural Hawkes Process: Application in Market-Making

Luca Lalor, Anatoliy Swishchuk

| Title | Authors | Year | Actions |

|---|

Comments (0)