John Cartlidge

16 papers on arXiv

Academic Profile

Statistics

Similar Authors

Papers on arXiv

Not feeling the buzz: Correction study of mispricing and inefficiency in online sportsbooks

We present a replication and correction of a recent article (Ramirez, P., Reade, J.J., Singleton, C., Betting on a buzz: Mispricing and inefficiency in online sportsbooks, International Journal of For...

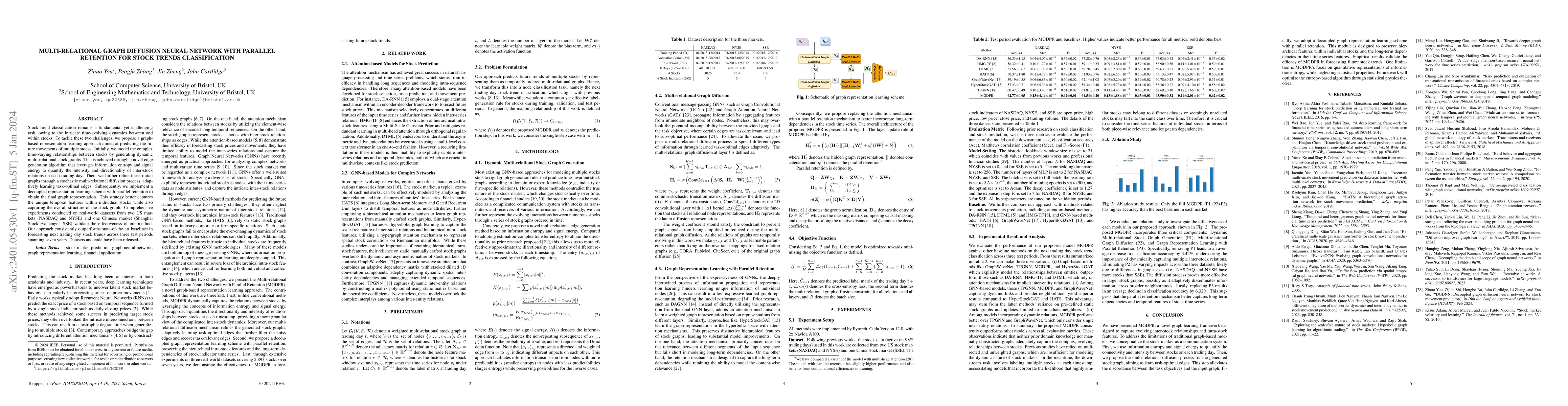

Multi-relational Graph Diffusion Neural Network with Parallel Retention for Stock Trends Classification

Stock trend classification remains a fundamental yet challenging task, owing to the intricate time-evolving dynamics between and within stocks. To tackle these two challenges, we propose a graph-bas...

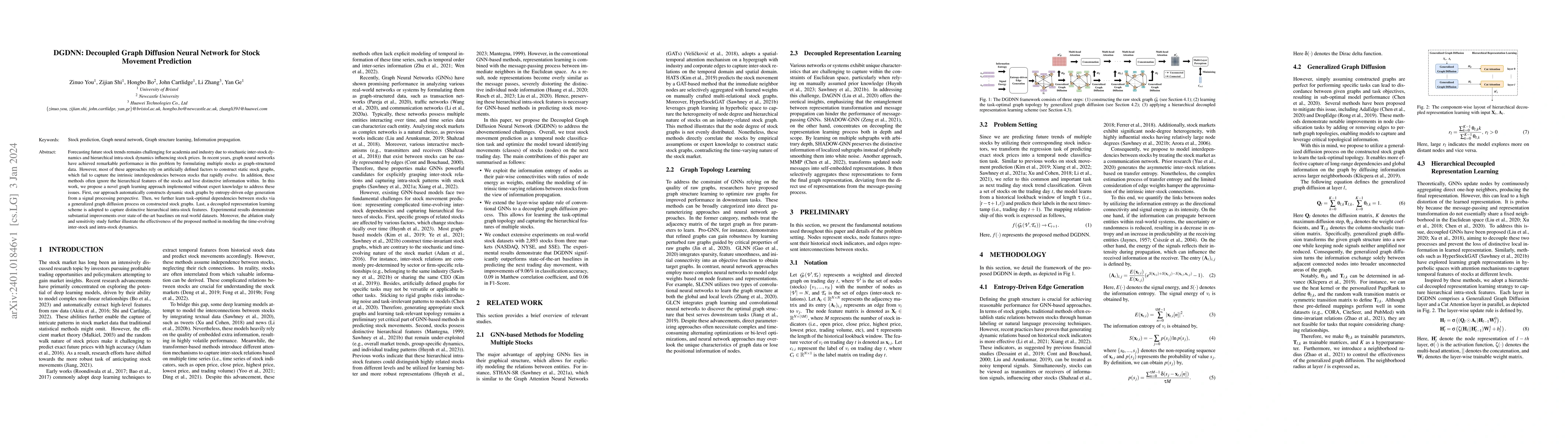

DGDNN: Decoupled Graph Diffusion Neural Network for Stock Movement Prediction

Forecasting future stock trends remains challenging for academia and industry due to stochastic inter-stock dynamics and hierarchical intra-stock dynamics influencing stock prices. In recent years, ...

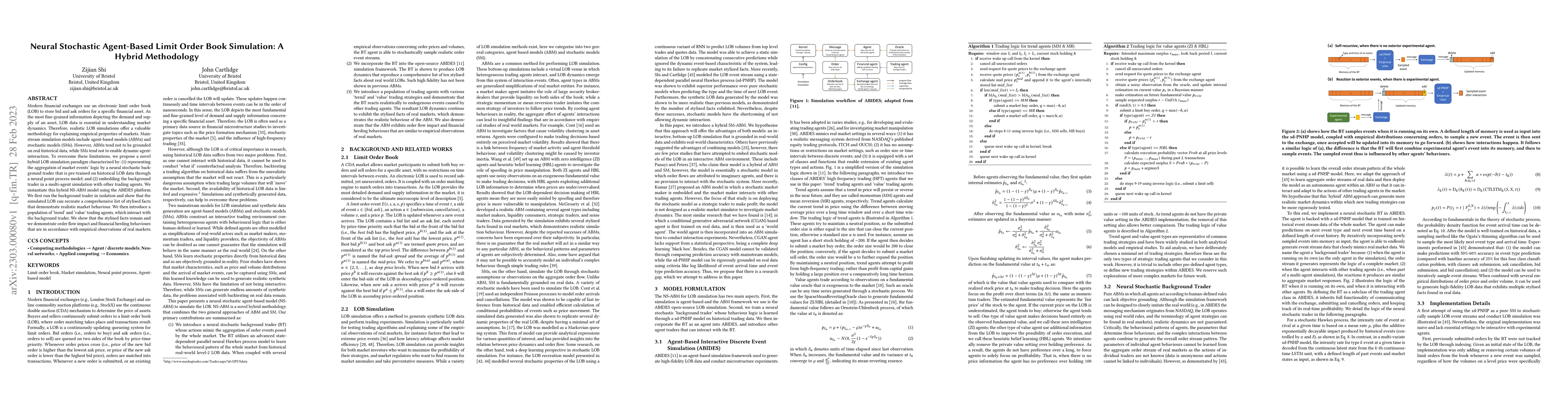

Neural Stochastic Agent-Based Limit Order Book Simulation: A Hybrid Methodology

Modern financial exchanges use an electronic limit order book (LOB) to store bid and ask orders for a specific financial asset. As the most fine-grained information depicting the demand and supply o...

Using coevolution and substitution of the fittest for health and well-being recommender systems

This research explores substitution of the fittest (SF), a technique designed to counteract the problem of disengagement in two-population competitive coevolutionary genetic algorithms. SF is domain...

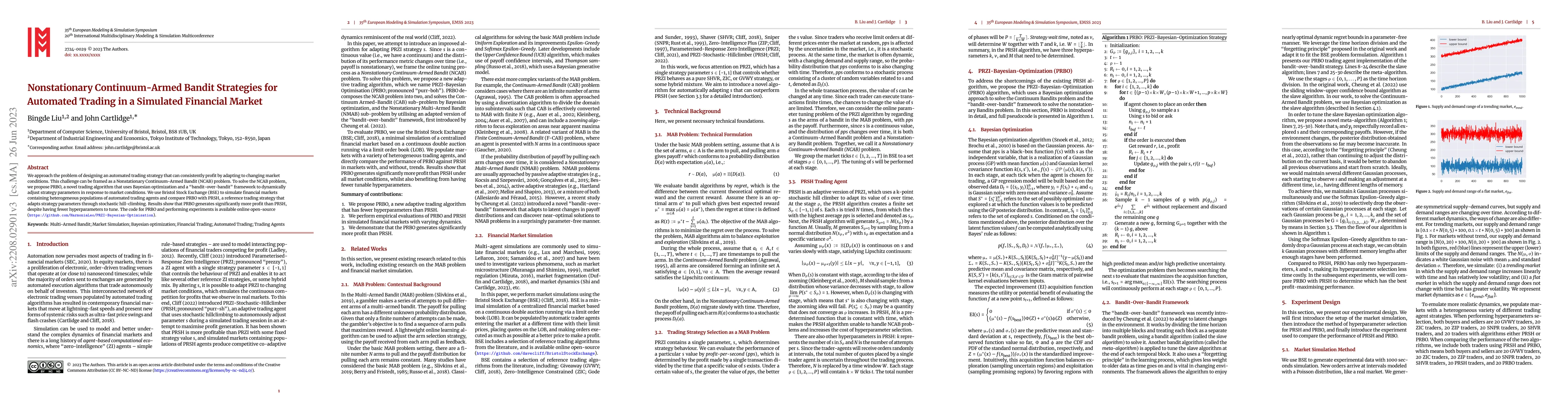

Nonstationary Continuum-Armed Bandit Strategies for Automated Trading in a Simulated Financial Market

We approach the problem of designing an automated trading strategy that can consistently profit by adapting to changing market conditions. This challenge can be framed as a Nonstationary Continuum-A...

Simulation of Social Media-Driven Bubble Formation in Financial Markets using an Agent-Based Model with Hierarchical Influence Network

We propose that a tree-like hierarchical structure represents a simple and effective way to model the emergent behaviour of financial markets, especially markets where there exists a pronounced inters...

Artificial Intelligence for Collective Intelligence: A National-Scale Research Strategy

Advances in artificial intelligence (AI) have great potential to help address societal challenges that are both collective in nature and present at national or trans-national scale. Pressing challenge...

Dynamic Graph Representation with Contrastive Learning for Financial Market Prediction: Integrating Temporal Evolution and Static Relations

Temporal Graph Learning (TGL) is crucial for capturing the evolving nature of stock markets. Traditional methods often ignore the interplay between dynamic temporal changes and static relational struc...

zkMixer: A Configurable Zero-Knowledge Mixer with Proof of Innocence and Anti-Money Laundering Consensus Protocols

We introduce a zero-knowledge cryptocurrency mixer framework that allows groups of users to set up a mixing pool with configurable governance conditions, configurable deposit delays, and the ability t...

Risk-aware black-box portfolio construction using Bayesian optimization with adaptive weighted Lagrangian estimator

Existing portfolio management approaches are often black-box models due to safety and commercial issues in the industry. However, their performance can vary considerably whenever market conditions or ...

Cross-Modal Temporal Fusion for Financial Market Forecasting

Accurate financial market forecasting requires diverse data sources, including historical price trends, macroeconomic indicators, and financial news, each contributing unique predictive signals. Howev...

Automated Risk Management Mechanisms in DeFi Lending Protocols: A Crosschain Comparative Analysis of Aave and Compound

Blockchain-based decentralised lending is a rapidly growing and evolving alternative to traditional lending, but it poses new risks. To mitigate these risks, lending protocols have integrated automate...

Deep Reinforcement Learning for Optimal Asset Allocation Using DDPG with TiDE

The optimal asset allocation between risky and risk-free assets is a persistent challenge due to the inherent volatility in financial markets. Conventional methods rely on strict distributional assump...

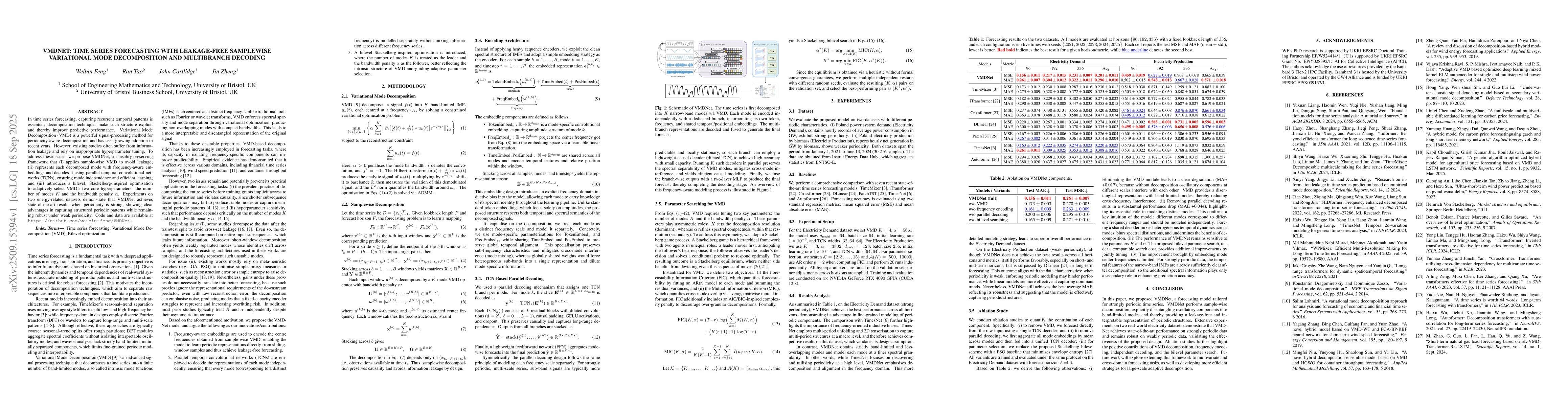

VMDNet: Time Series Forecasting with Leakage-Free Samplewise Variational Mode Decomposition and Multibranch Decoding

In time series forecasting, capturing recurrent temporal patterns is essential; decomposition techniques make such structure explicit and thereby improve predictive performance. Variational Mode Decom...

Intransitive Player Dominance and Market Inefficiency in Tennis Forecasting: A Graph Neural Network Approach

Intransitive player dominance, where player A beats B, B beats C, but C beats A, is common in competitive tennis. Yet, there are few known attempts to incorporate it within forecasting methods. We add...