Authors

Summary

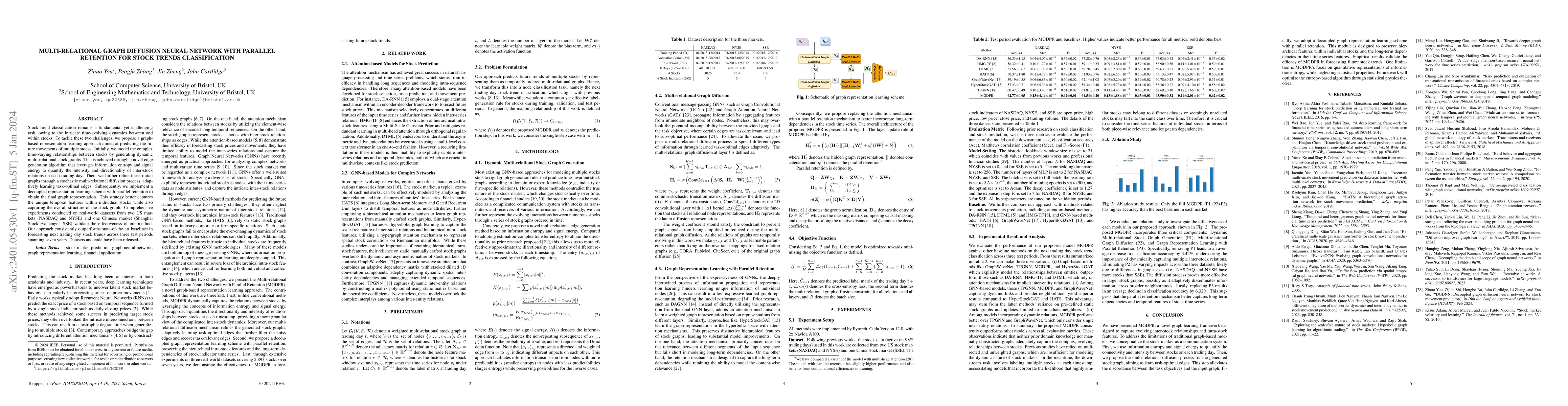

Stock trend classification remains a fundamental yet challenging task, owing to the intricate time-evolving dynamics between and within stocks. To tackle these two challenges, we propose a graph-based representation learning approach aimed at predicting the future movements of multiple stocks. Initially, we model the complex time-varying relationships between stocks by generating dynamic multi-relational stock graphs. This is achieved through a novel edge generation algorithm that leverages information entropy and signal energy to quantify the intensity and directionality of inter-stock relations on each trading day. Then, we further refine these initial graphs through a stochastic multi-relational diffusion process, adaptively learning task-optimal edges. Subsequently, we implement a decoupled representation learning scheme with parallel retention to obtain the final graph representation. This strategy better captures the unique temporal features within individual stocks while also capturing the overall structure of the stock graph. Comprehensive experiments conducted on real-world datasets from two US markets (NASDAQ and NYSE) and one Chinese market (Shanghai Stock Exchange: SSE) validate the effectiveness of our method. Our approach consistently outperforms state-of-the-art baselines in forecasting next trading day stock trends across three test periods spanning seven years. Datasets and code have been released (https://github.com/pixelhero98/MGDPR).

AI Key Findings

Generated Sep 07, 2025

Methodology

The paper proposes a multi-relational graph diffusion neural network (MGDPR) for stock trend classification, utilizing dynamic multi-relational stock graphs, a stochastic multi-relational diffusion process, and a decoupled representation learning scheme with parallel retention to capture temporal features and overall stock graph structure.

Key Results

- MGDPR outperforms state-of-the-art baselines in forecasting next trading day stock trends across three test periods spanning seven years on datasets from NASDAQ, NYSE, and SSE markets.

- Graph-based methods like GraphWaveNet, TPGNN, MGDPR, and HyperStockGAT outperform attention-based methods like DA-RNN, HMG-TF, and DTML.

- Models capturing dynamic links and broader neighborhoods (TPGNN, MGDPR, GraphWaveNet) yield superior results compared to HyperStockGAT and HATS.

Significance

This research is significant as it addresses the limitations of traditional graph-based models by considering the stock market as a communication system, dynamically capturing inter-stock relationships, and incorporating time-series features of individual stocks.

Technical Contribution

The paper introduces a novel multi-relational graph diffusion neural network (MGDPR) for stock trend classification, which dynamically generates multi-relational stock graphs, employs a stochastic multi-relational diffusion process, and uses a decoupled representation learning scheme with parallel retention.

Novelty

MGDPR differs from existing research by modeling the stock market as a communication system, dynamically capturing inter-stock relationships using information entropy and signal energy, and employing a parallel retention mechanism to better capture long-term dependencies in stock time-series features.

Limitations

- MGDPR focuses on quantitative representation of information entropy, neglecting statistical properties.

- The method may not fully capture the complex, evolving relationships between stocks due to the use of undirected and unweighted graphs.

Future Work

- Optimize the entropy-based algorithm using statistical physics theories.

- Investigate the incorporation of more sophisticated graph structures to better model the dynamic nature of stock markets.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMDGNN: Multi-Relational Dynamic Graph Neural Network for Comprehensive and Dynamic Stock Investment Prediction

Hao Chen, Zhiqiang Zhang, Jun Zhou et al.

DGDNN: Decoupled Graph Diffusion Neural Network for Stock Movement Prediction

Li Zhang, Zijian Shi, Yan Ge et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)