Authors

Summary

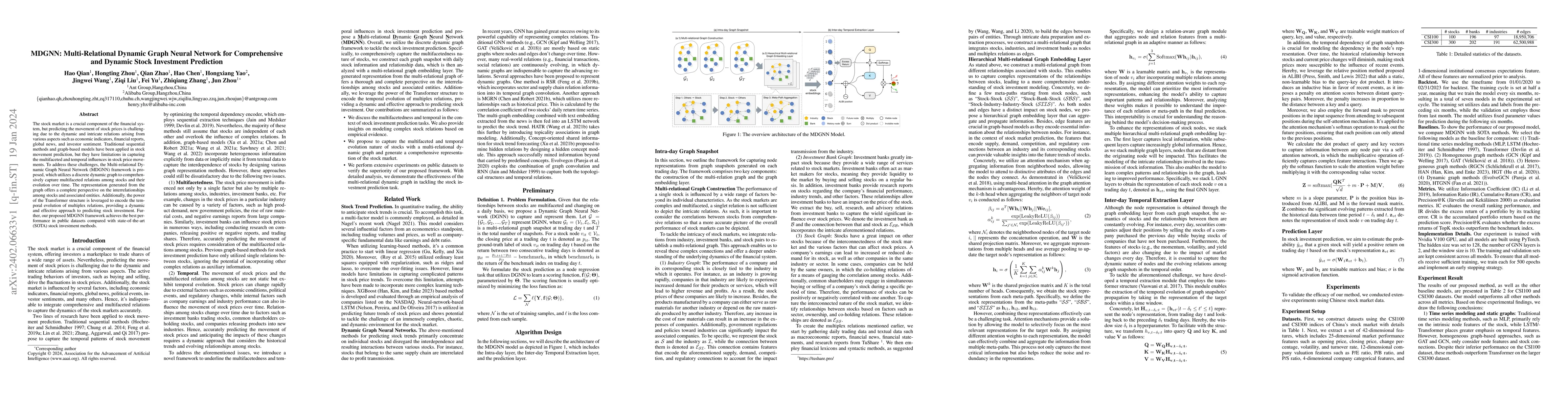

The stock market is a crucial component of the financial system, but predicting the movement of stock prices is challenging due to the dynamic and intricate relations arising from various aspects such as economic indicators, financial reports, global news, and investor sentiment. Traditional sequential methods and graph-based models have been applied in stock movement prediction, but they have limitations in capturing the multifaceted and temporal influences in stock price movements. To address these challenges, the Multi-relational Dynamic Graph Neural Network (MDGNN) framework is proposed, which utilizes a discrete dynamic graph to comprehensively capture multifaceted relations among stocks and their evolution over time. The representation generated from the graph offers a complete perspective on the interrelationships among stocks and associated entities. Additionally, the power of the Transformer structure is leveraged to encode the temporal evolution of multiplex relations, providing a dynamic and effective approach to predicting stock investment. Further, our proposed MDGNN framework achieves the best performance in public datasets compared with state-of-the-art (SOTA) stock investment methods.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMulti-Relational Graph Neural Network for Out-of-Domain Link Prediction

Davide Bacciu, Asma Sattar, Georgios Deligiorgis et al.

Multi-relational Graph Diffusion Neural Network with Parallel Retention for Stock Trends Classification

Jin Zheng, Zinuo You, Pengju Zhang et al.

Stock Type Prediction Model Based on Hierarchical Graph Neural Network

Jianhua Yao, Yuxin Dong, Hongye Zheng et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)