Summary

Existing portfolio management approaches are often black-box models due to safety and commercial issues in the industry. However, their performance can vary considerably whenever market conditions or internal trading strategies change. Furthermore, evaluating these non-transparent systems is expensive, where certain budgets limit observations of the systems. Therefore, optimizing performance while controlling the potential risk of these financial systems has become a critical challenge. This work presents a novel Bayesian optimization framework to optimize black-box portfolio management models under limited observations. In conventional Bayesian optimization settings, the objective function is to maximize the expectation of performance metrics. However, simply maximizing performance expectations leads to erratic optimization trajectories, which exacerbate risk accumulation in portfolio management. Meanwhile, this can lead to misalignment between the target distribution and the actual distribution of the black-box model. To mitigate this problem, we propose an adaptive weight Lagrangian estimator considering dual objective, which incorporates maximizing model performance and minimizing variance of model observations. Extensive experiments demonstrate the superiority of our approach over five backtest settings with three black-box stock portfolio management models. Ablation studies further verify the effectiveness of the proposed estimator.

AI Key Findings

Generated Jun 09, 2025

Methodology

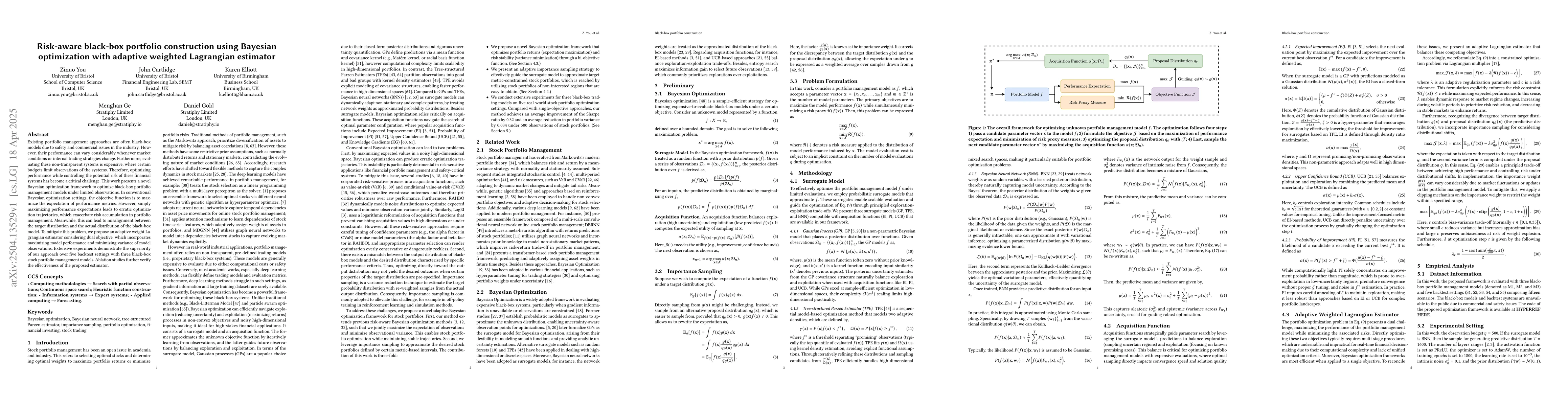

This paper proposes a novel Bayesian optimization framework for optimizing black-box portfolio management models under limited observations, using an adaptive weighted Lagrangian estimator to balance performance maximization and risk minimization.

Key Results

- The proposed adaptive weighted Lagrangian estimator outperforms conventional methods in maintaining maximum model performance while reducing variance in observations of model performance.

- TPE with EI generally outperforms other methods across three black-box portfolio management models and five backtest settings.

- TPE with EI surpasses other surrogate-acquisition pairs in optimization efficiency, realizing faster optimization given the same observation budget.

Significance

This research is significant for modern financial applications that require optimizing model performance while controlling volatility, especially when evaluation budgets are limited or models operate in dynamic environments.

Technical Contribution

The paper introduces an adaptive weighted Lagrangian estimator for Bayesian optimization, which balances performance optimization and risk control in black-box portfolio management models.

Novelty

The proposed method differs from existing research by explicitly addressing the dual challenge of maximizing portfolio management model performance while minimizing associated risks, using a single-objective Bayesian optimization framework.

Limitations

- The weight clipping relies on tuning the hyperparameter 𝜖, which can result in drastic weight changes or severe bias if not carefully balanced.

- The magnitude of the regularization term 𝜆𝑡 requires appropriate tuning when the two terms in the proposed estimator do not have similar scales.

Future Work

- Integration of uncertainty estimates into the density models used by TPE-based Bayesian optimization.

- Exploration of alternative methods for tuning the hyperparameter 𝜖 and regularization term 𝜆𝑡.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersRisk-aware Trading Portfolio Optimization

Gianmarco De Francisci Morales, Gabriele D'Acunto, Fabio Vitale et al.

Sharpness-Aware Black-Box Optimization

Yu Zhang, Masashi Sugiyama, Ivor Tsang et al.

No citations found for this paper.

Comments (0)