Authors

Summary

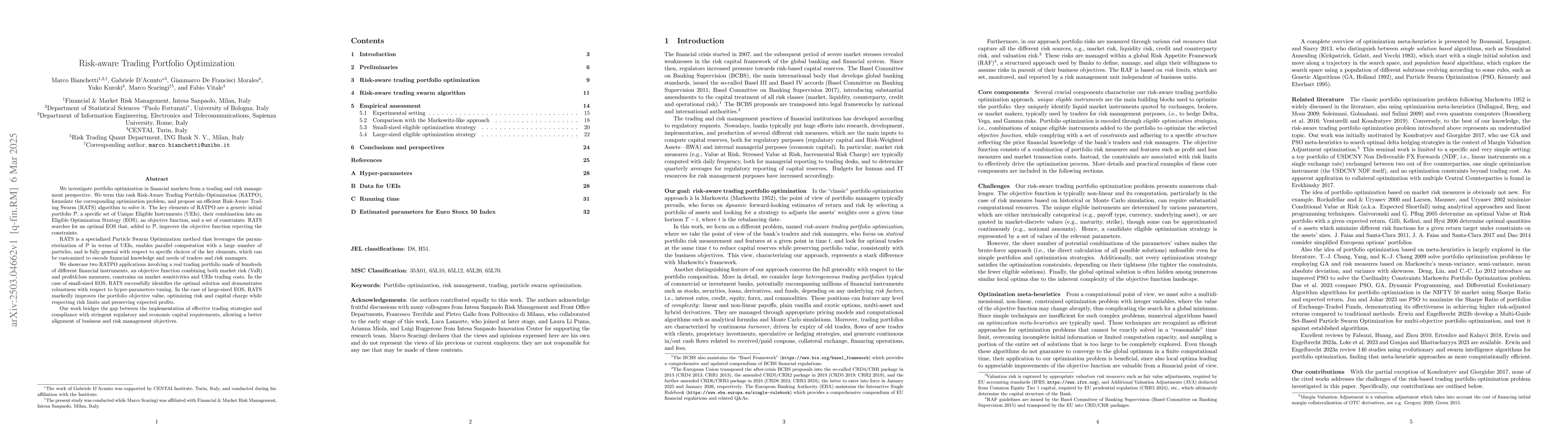

We investigate portfolio optimization in financial markets from a trading and risk management perspective. We term this task Risk-Aware Trading Portfolio Optimization (RATPO), formulate the corresponding optimization problem, and propose an efficient Risk-Aware Trading Swarm (RATS) algorithm to solve it. The key elements of RATPO are a generic initial portfolio P, a specific set of Unique Eligible Instruments (UEIs), their combination into an Eligible Optimization Strategy (EOS), an objective function, and a set of constraints. RATS searches for an optimal EOS that, added to P, improves the objective function repecting the constraints. RATS is a specialized Particle Swarm Optimization method that leverages the parameterization of P in terms of UEIs, enables parallel computation with a large number of particles, and is fully general with respect to specific choices of the key elements, which can be customized to encode financial knowledge and needs of traders and risk managers. We showcase two RATPO applications involving a real trading portfolio made of hundreds of different financial instruments, an objective function combining both market risk (VaR) and profit&loss measures, constrains on market sensitivities and UEIs trading costs. In the case of small-sized EOS, RATS successfully identifies the optimal solution and demonstrates robustness with respect to hyper-parameters tuning. In the case of large-sized EOS, RATS markedly improves the portfolio objective value, optimizing risk and capital charge while respecting risk limits and preserving expected profits. Our work bridges the gap between the implementation of effective trading strategies and compliance with stringent regulatory and economic capital requirements, allowing a better alignment of business and risk management objectives.

AI Key Findings

Generated Jun 10, 2025

Methodology

The research proposes Risk-Aware Trading Portfolio Optimization (RATPO) and develops the Risk-Aware Trading Swarm (RATS) algorithm, a specialized Particle Swarm Optimization method, to solve RATPO. RATS efficiently searches for an optimal Eligible Optimization Strategy (EOS) that, when added to an initial portfolio, improves the objective function while respecting constraints.

Key Results

- RATS successfully identifies the optimal solution for small-sized EOS and demonstrates robustness with respect to hyper-parameters tuning.

- For large-sized EOS, RATS markedly improves the portfolio objective value, optimizing risk and capital charge while respecting risk limits and preserving expected profits.

- The approach bridges the gap between implementing effective trading strategies and complying with stringent regulatory and economic capital requirements, aligning business and risk management objectives.

Significance

This work is significant as it provides a versatile computational tool for financial institutions to optimize trading portfolios, considering various risk measures and constraints, thus improving risk management and capital efficiency.

Technical Contribution

The paper introduces RATPO and RATS, a specialized Particle Swarm Optimization method, which can be adapted to different trading portfolios, objective functions, and constraints, incorporating financial insights and business perspectives of traders and risk managers.

Novelty

The proposed RATPO problem and RATS algorithm bridge the gap between trading strategy implementation and regulatory compliance, offering a general framework for large-scale portfolio optimization that aligns business and risk management objectives.

Limitations

- The non-convexity and potential non-differentiability of the objective function in Equation (18) may pose challenges for direct application of gradient-based optimization methods.

- Managing the complexities of the feasible set of eligible optimization strategies, which may include non-linear forms and require methods to promote sparsity without biased estimation of notional amounts, is a critical area for future research.

Future Work

- Investigating the development of a gradient-based, continuous optimization M-approach to solve (˜P1) could be an interesting research direction.

- Exploring suitable convex and differentiable surrogates for the objective function in Equation (18) and methods to handle the complexities of the feasible set of eligible optimization strategies.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

No citations found for this paper.

Comments (0)