Authors

Summary

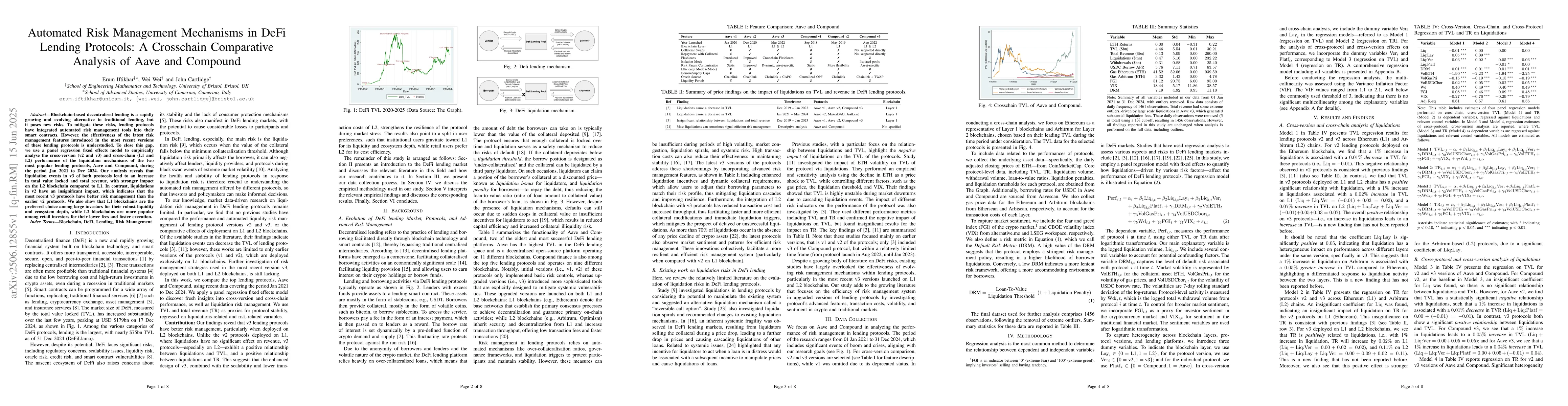

Blockchain-based decentralised lending is a rapidly growing and evolving alternative to traditional lending, but it poses new risks. To mitigate these risks, lending protocols have integrated automated risk management tools into their smart contracts. However, the effectiveness of the latest risk management features introduced in the most recent versions of these lending protocols is understudied. To close this gap, we use a panel regression fixed effects model to empirically analyse the cross-version (v2 and v3) and cross-chain (L1 and L2) performance of the liquidation mechanisms of the two most popular lending protocols, Aave and Compound, during the period Jan 2021 to Dec 2024. Our analysis reveals that liquidation events in v3 of both protocols lead to an increase in total value locked and total revenue, with stronger impact on the L2 blockchain compared to L1. In contrast, liquidations in v2 have an insignificant impact, which indicates that the most recent v3 protocols have better risk management than the earlier v2 protocols. We also show that L1 blockchains are the preferred choice among large investors for their robust liquidity and ecosystem depth, while L2 blockchains are more popular among retail investors for their lower fees and faster execution.

AI Key Findings

Generated Sep 03, 2025

Methodology

The study employs a panel regression fixed effects model to analyze the cross-version (v2 and v3) and cross-chain (L1 and L2) performance of liquidation mechanisms in Aave and Compound during 2021-2024.

Key Results

- Liquidation events in v3 of both protocols lead to an increase in total value locked (TVL) and total revenue, with a stronger impact on L2 blockchain compared to L1.

- In contrast, liquidations in v2 have an insignificant impact, indicating that v3 protocols have better risk management than v2.

- L1 blockchains are preferred by large investors for robust liquidity and ecosystem depth, while L2 blockchains are more popular among retail investors due to lower fees and faster execution.

Significance

This research contributes to understanding the effectiveness of evolving risk management mechanisms in DeFi lending protocols, particularly in the most recent v3 versions on L1 and L2 blockchains.

Technical Contribution

The paper presents a comprehensive cross-chain and cross-version comparative analysis of liquidation mechanisms in leading DeFi lending protocols, Aave and Compound.

Novelty

The study identifies significant improvements in risk management and liquidation efficiency in v3 protocols compared to v2, highlighting advancements in automated risk management tools in DeFi lending protocols.

Limitations

- The study focuses on Aave and Compound, potentially limiting the generalizability of findings to other DeFi lending protocols.

- It does not account for external market factors beyond the specified period (Jan 2021 - Dec 2024).

Future Work

- Investigate wallet-level behavior of lenders, borrowers, and liquidators during and after liquidation events.

- Explore the total value redeemed (TVR) as an alternative performance measure to TVL.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersLiquidity Risks in Lending Protocols: Evidence from Aave Protocol

Xiaotong Sun, Charalampos Stasinakis, Georgios Sermpinis

From banks to DeFi: the evolution of the lending market

Jiahua Xu, Nikhil Vadgama

No citations found for this paper.

Comments (0)