Summary

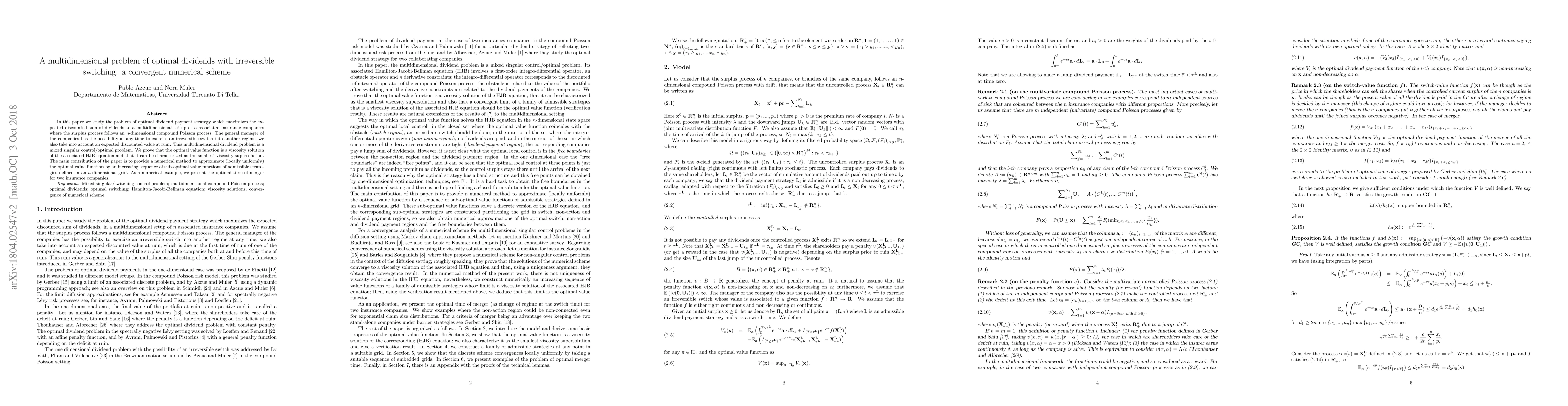

In this paper we study the problem of optimal dividend payment strategy which maximizes the expected discounted sum of dividends to a multidimensional set up of n associated insurance companies where the surplus process follows an n-dimensional compound Poisson process. The general manager of the companies has the possibility at any time to exercise an irreversible switch into another regime; we also take into account an expected discounted value at ruin. This multidimensional dividend problem is a mixed singular control/optimal problem. We prove that the optimal value function is a viscosity solution of the associated HJB equation and that it can be characterized as the smallest viscosity supersolution. The main contribution of the paper is to provide a numerical method to approximate (locally uniformly) the optimal value function by an increasing sequence of sub-optimal value functions of admissible strategies defined in an n-dimensional grid. As a numerical example, we present the optimal time of merger for two insurance companies.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)