Summary

In this paper we consider a modified version of the classical optimal dividends problem of de Finetti in which the dividend payments subject to a penalty at ruin. We assume that the risk process is modeled by a general spectrally positive Levy process before dividends are deducted. Using the fluctuation theory of spectrally positive Levy processes we give an explicit expression of the value function of a barrier strategy. Subsequently we show that a barrier strategy is the optimal strategy among all admissible ones. Our work is motivated by the recent work of Bayraktar, Kyprianou and Yamazaki (2013).

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

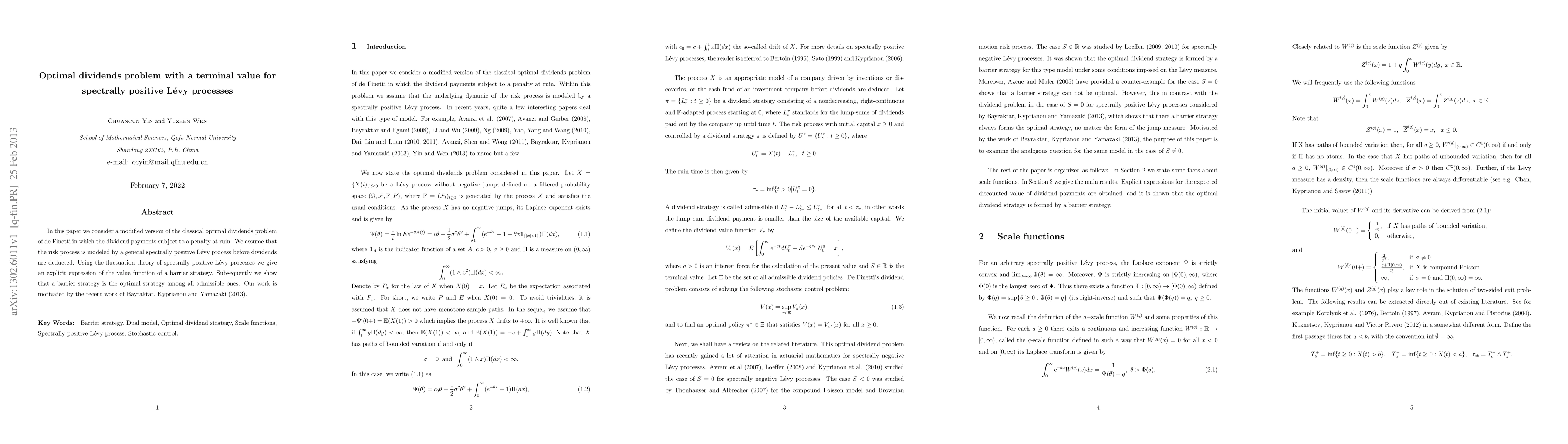

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)