Summary

In this paper we study the optimal dividend problem for a company whose surplus process evolves as a spectrally positive Levy process. This model including the dual model of the classical risk model and the dual model with diffusion as special cases. We assume that dividends are paid to the shareholders according to admissible strategy whose dividend rate is bounded by a constant. The objective is to find a dividend policy so as to maximize the expected discounted value of dividends which are paid to the shareholders until the company is ruined. We show that the optimal dividend strategy is formed by a threshold strategy.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

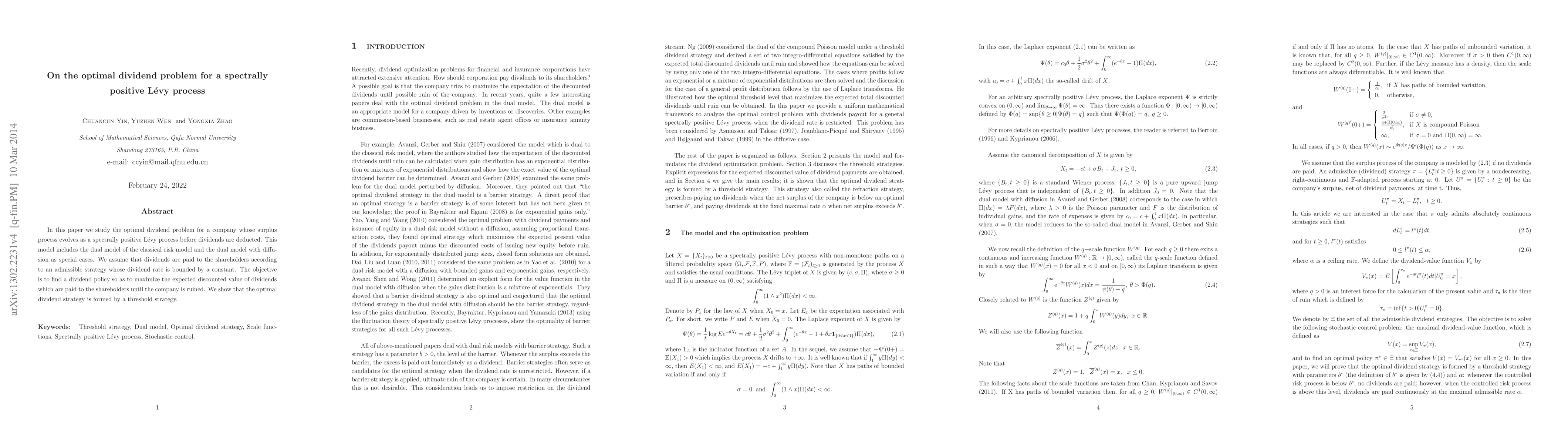

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)