Summary

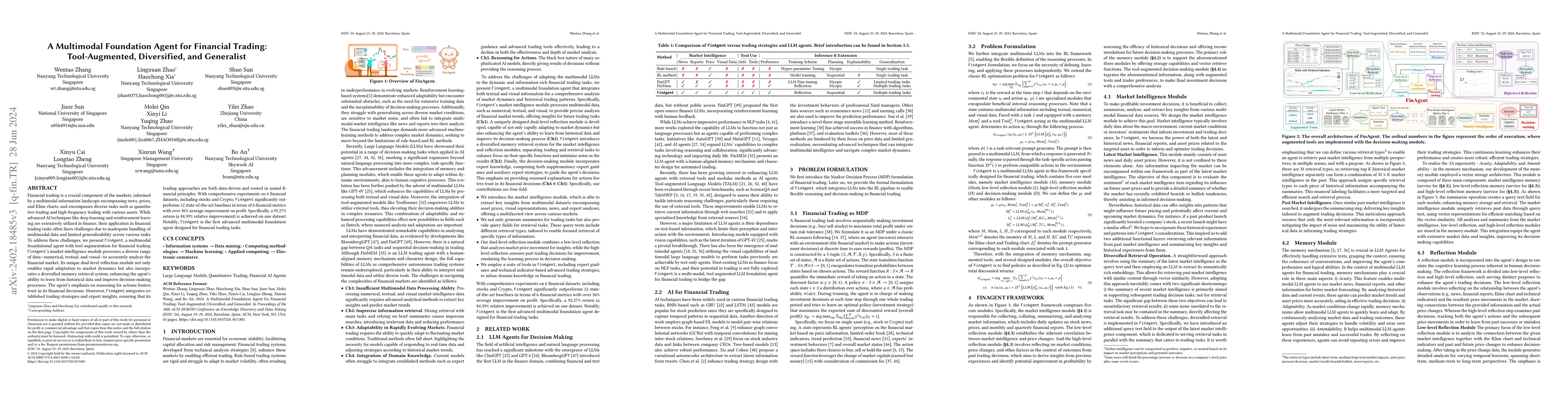

Financial trading is a crucial component of the markets, informed by a multimodal information landscape encompassing news, prices, and Kline charts, and encompasses diverse tasks such as quantitative trading and high-frequency trading with various assets. While advanced AI techniques like deep learning and reinforcement learning are extensively utilized in finance, their application in financial trading tasks often faces challenges due to inadequate handling of multimodal data and limited generalizability across various tasks. To address these challenges, we present FinAgent, a multimodal foundational agent with tool augmentation for financial trading. FinAgent's market intelligence module processes a diverse range of data-numerical, textual, and visual-to accurately analyze the financial market. Its unique dual-level reflection module not only enables rapid adaptation to market dynamics but also incorporates a diversified memory retrieval system, enhancing the agent's ability to learn from historical data and improve decision-making processes. The agent's emphasis on reasoning for actions fosters trust in its financial decisions. Moreover, FinAgent integrates established trading strategies and expert insights, ensuring that its trading approaches are both data-driven and rooted in sound financial principles. With comprehensive experiments on 6 financial datasets, including stocks and Crypto, FinAgent significantly outperforms 9 state-of-the-art baselines in terms of 6 financial metrics with over 36% average improvement on profit. Specifically, a 92.27% return (a 84.39% relative improvement) is achieved on one dataset. Notably, FinAgent is the first advanced multimodal foundation agent designed for financial trading tasks.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMultimodal foundation world models for generalist embodied agents

Tim Verbelen, Aaron Courville, Pietro Mazzaglia et al.

TAMA: Tool-Augmented Multimodal Agent for Procedural Activity Understanding

Teruko Mitamura, Ken Fukuda, Kimihiro Hasegawa et al.

EyeFound: A Multimodal Generalist Foundation Model for Ophthalmic Imaging

Siyu Huang, Yexin Liu, Yih Chung Tham et al.

InfantAgent-Next: A Multimodal Generalist Agent for Automated Computer Interaction

Ali Payani, Caiwen Ding, Yan Yan et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)