Authors

Summary

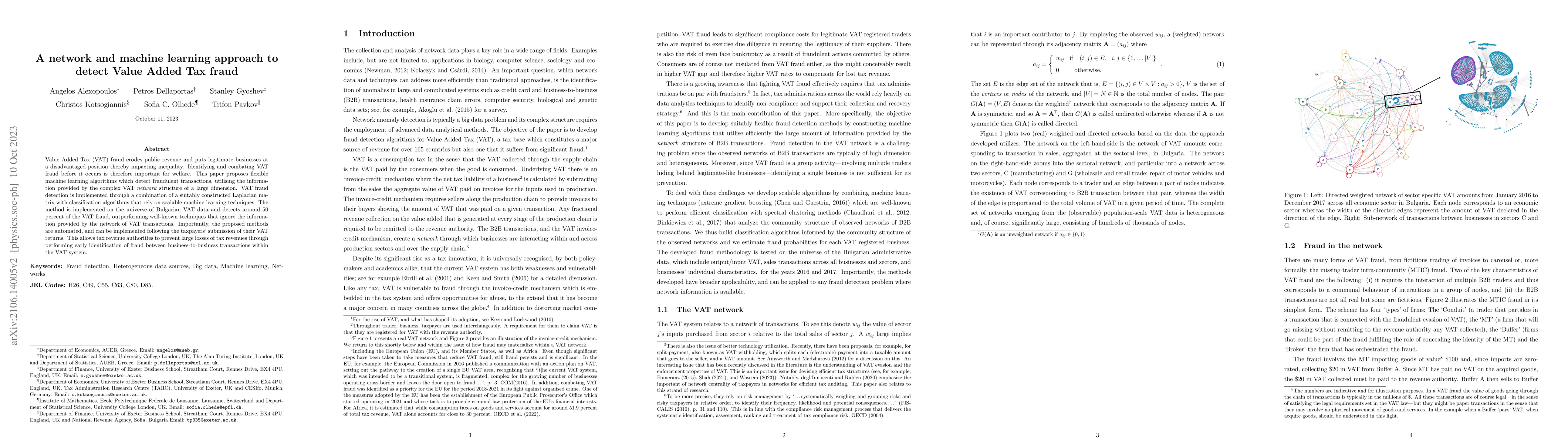

Value Added Tax (VAT) fraud erodes public revenue and puts legitimate businesses at a disadvantaged position thereby impacting inequality. Identifying and combating VAT fraud before it occurs is therefore important for welfare. This paper proposes flexible machine learning algorithms which detect fraudulent transactions, utilising the information provided by the complex VAT network structure of a large dimension. VAT fraud detection is implemented through a combination of a suitably constructed Laplacian matrix with classification algorithms that rely on scalable machine learning techniques. The method is implemented on the universe of Bulgarian VAT data and detects around 50 percent of the VAT fraud, outperforming well-known techniques that ignore the information provided by the network of VAT transactions. Importantly, the proposed methods are automated, and can be implemented following the taxpayers submission of their VAT returns. This allows tax revenue authorities to prevent large losses of tax revenues through performing early identification of fraud between business-to-business transactions within the VAT system.

AI Key Findings - Processing

Key findings are being generated. Please check back in a few minutes.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersEnhancement to Training of Bidirectional GAN : An Approach to Demystify Tax Fraud

Ravi Kumar, Sandeep Kumar, Ch. Sobhan Babu et al.

A novel approach to increase scalability while training machine learning algorithms using Bfloat 16 in credit card fraud detection

Rejwan Bin Sulaiman, Musarrat Saberin Nipun, Bushra Yousuf

A machine learning procedure to detect network attacks

Davide Coppes, Paolo Cermelli

| Title | Authors | Year | Actions |

|---|

Comments (0)