Summary

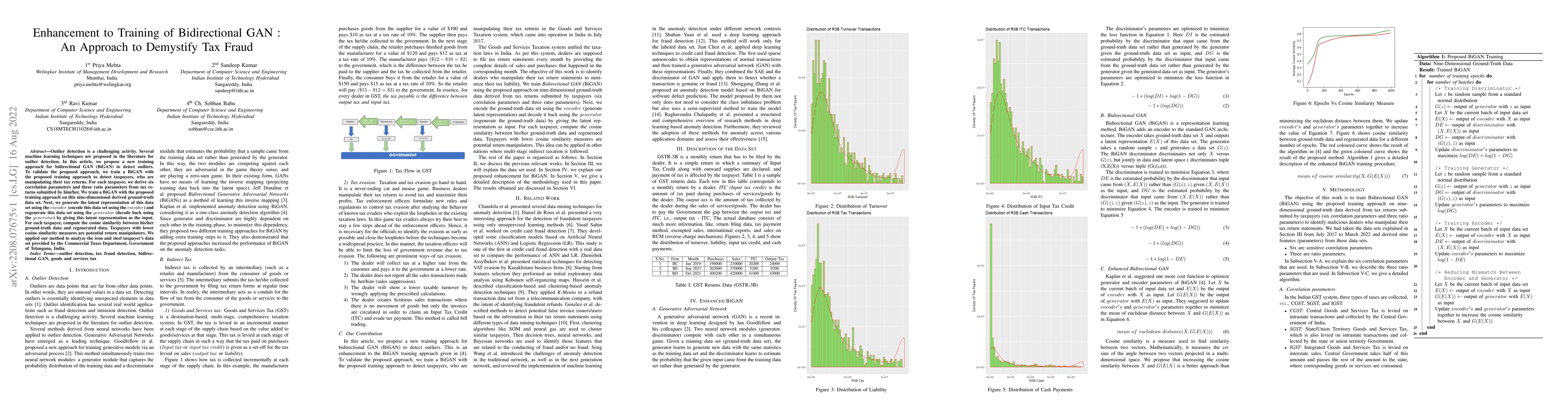

Outlier detection is a challenging activity. Several machine learning techniques are proposed in the literature for outlier detection. In this article, we propose a new training approach for bidirectional GAN (BiGAN) to detect outliers. To validate the proposed approach, we train a BiGAN with the proposed training approach to detect taxpayers, who are manipulating their tax returns. For each taxpayer, we derive six correlation parameters and three ratio parameters from tax returns submitted by him/her. We train a BiGAN with the proposed training approach on this nine-dimensional derived ground-truth data set. Next, we generate the latent representation of this data set using the $encoder$ (encode this data set using the $encoder$) and regenerate this data set using the $generator$ (decode back using the $generator$) by giving this latent representation as the input. For each taxpayer, compute the cosine similarity between his/her ground-truth data and regenerated data. Taxpayers with lower cosine similarity measures are potential return manipulators. We applied our method to analyze the iron and steel taxpayers data set provided by the Commercial Taxes Department, Government of Telangana, India.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA network and machine learning approach to detect Value Added Tax fraud

Petros Dellaportas, Sofia C. Olhede, Angelos Alexopoulos et al.

A new approach to the theory of optimal income tax

Vassili N. Kolokoltsov, Egor M. Dranov, Denis E. Piskun

Spider GAN: Leveraging Friendly Neighbors to Accelerate GAN Training

Chandra Sekhar Seelamantula, Siddarth Asokan

| Title | Authors | Year | Actions |

|---|

Comments (0)