Authors

Summary

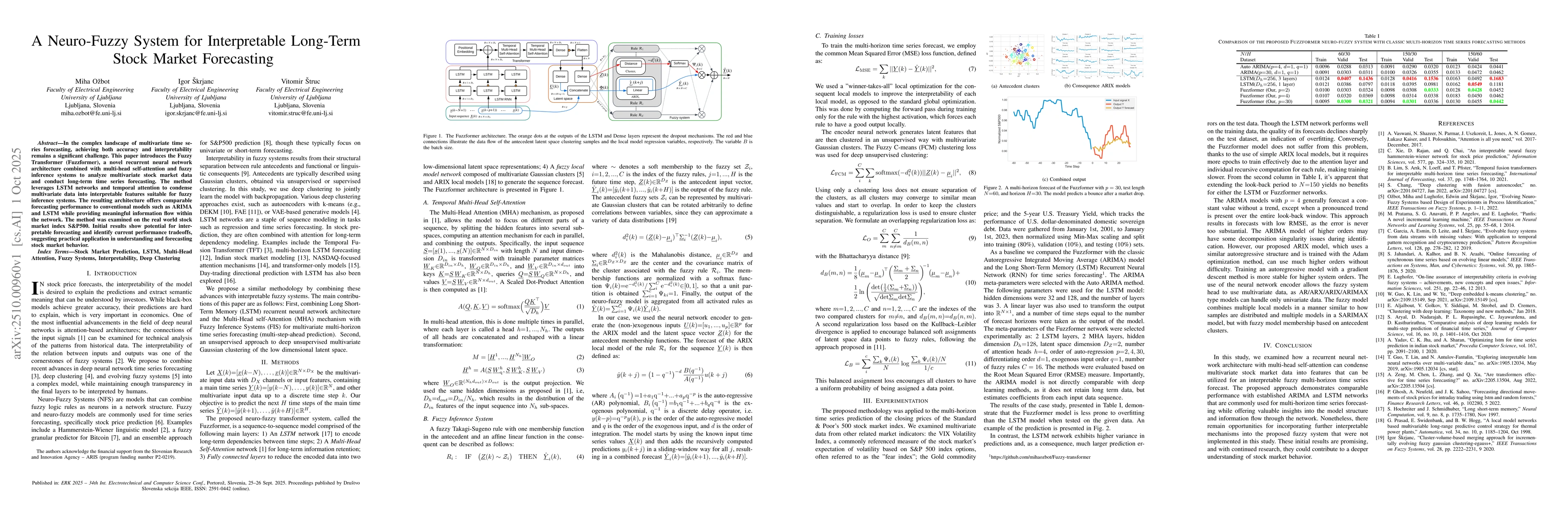

In the complex landscape of multivariate time series forecasting, achieving both accuracy and interpretability remains a significant challenge. This paper introduces the Fuzzy Transformer (Fuzzformer), a novel recurrent neural network architecture combined with multi-head self-attention and fuzzy inference systems to analyze multivariate stock market data and conduct long-term time series forecasting. The method leverages LSTM networks and temporal attention to condense multivariate data into interpretable features suitable for fuzzy inference systems. The resulting architecture offers comparable forecasting performance to conventional models such as ARIMA and LSTM while providing meaningful information flow within the network. The method was examined on the real world stock market index S\&P500. Initial results show potential for interpretable forecasting and identify current performance tradeoffs, suggesting practical application in understanding and forecasting stock market behavior.

AI Key Findings

Generated Oct 05, 2025

Methodology

The paper introduces Fuzzformer, a hybrid model combining LSTM networks, multi-head self-attention mechanisms, and fuzzy inference systems to analyze multivariate stock market data for long-term forecasting. It uses deep clustering for unsupervised Gaussian clustering of latent spaces and incorporates ARIX local models for sequence prediction.

Key Results

- Fuzzformer achieves comparable forecasting performance to ARIMA and LSTM while providing interpretable information flow.

- The model demonstrates reduced overfitting compared to LSTM, with lower RMSE on test data.

- Fuzzformer successfully captures market trends and predicts rebounds after market drops, as shown in experimental results.

Significance

This research bridges the gap between accurate forecasting and model interpretability in stock market prediction, offering practical insights for investors and financial analysts. The integration of fuzzy logic with deep learning provides a transparent framework for understanding complex market behaviors.

Technical Contribution

The paper proposes a novel architecture that combines LSTM, multi-head attention, and fuzzy inference systems with deep clustering for latent space representation, enabling interpretable long-term stock market forecasting.

Novelty

The key novelty lies in integrating fuzzy logic with attention-based deep learning for multivariate time series forecasting, providing both accuracy and interpretability through structured rule-based fuzzy systems and unsupervised clustering techniques.

Limitations

- Training is slower due to attention layers and recursive computations for each fuzzy rule.

- The model's performance may be limited by the quality and availability of multivariate financial data.

Future Work

- Incorporating additional interpretable mechanisms into the fuzzy system for enhanced transparency.

- Extending the framework to handle real-time data streams and dynamic market conditions.

- Exploring hybrid models with other explainable AI techniques for broader financial applications.

Paper Details

PDF Preview

Similar Papers

Found 4 papersOptimizing adaptive neuro-fuzzy inference system model based Chaotic Harris Hawks algorithm for stock prediction.

Mohamed, Zahraa Elsayed, Refaie Ali, Ahmed, Dabour, Walid

MASTER: Market-Guided Stock Transformer for Stock Price Forecasting

Yanyan Shen, Zhaoyang Liu, Tong Li et al.

Distilling Deep RL Models Into Interpretable Neuro-Fuzzy Systems

Yvan Saeys, Jonathan Peck, Arne Gevaert

Comments (0)