Summary

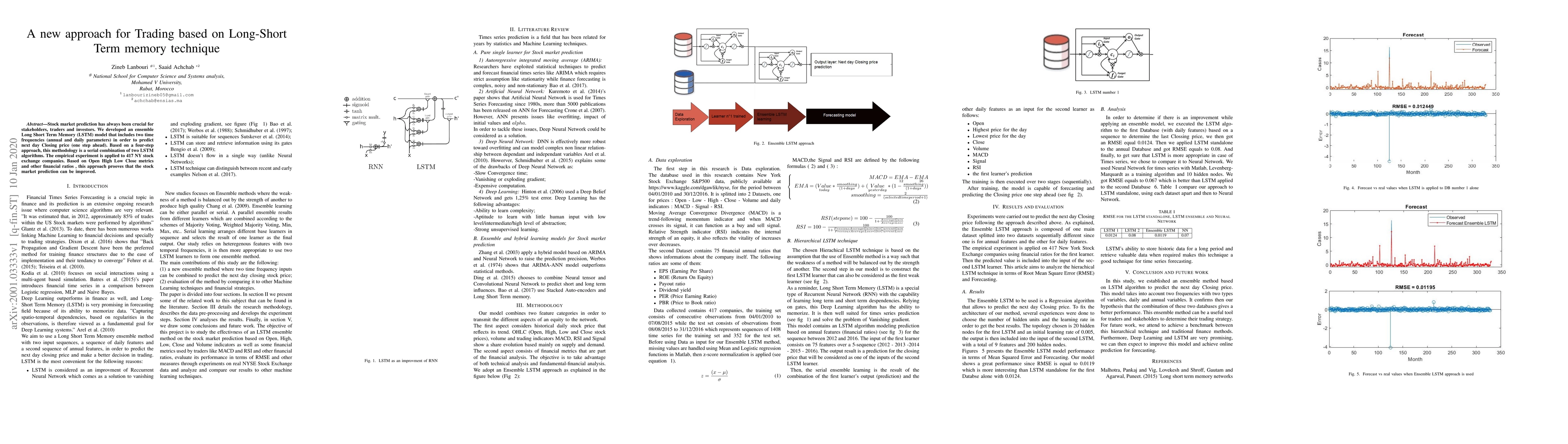

The stock market prediction has always been crucial for stakeholders, traders and investors. We developed an ensemble Long Short Term Memory (LSTM) model that includes two-time frequencies (annual and daily parameters) in order to predict the next-day Closing price (one step ahead). Based on a four-step approach, this methodology is a serial combination of two LSTM algorithms. The empirical experiment is applied to 417 NY stock exchange companies. Based on Open High Low Close metrics and other financial ratios, this approach proves that the stock market prediction can be improved.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOptimum Output Long Short-Term Memory Cell for High-Frequency Trading Forecasting

Moncef Gabbouj, Juho Kanniainen, Adamantios Ntakaris

| Title | Authors | Year | Actions |

|---|

Comments (0)