Summary

For a functionally generated portfolio, there is a natural decomposition of the relative log-return into the log-change in the generating function and a drift process. In this note, this decomposition is extended to arbitrary stock portfolios by an application of Fisk-Stratonovich integration. With the extended methodology, the generating function is represented by a structural process, and the drift process is subsumed into a trading process that measures the profit and loss to the portfolio from trading.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

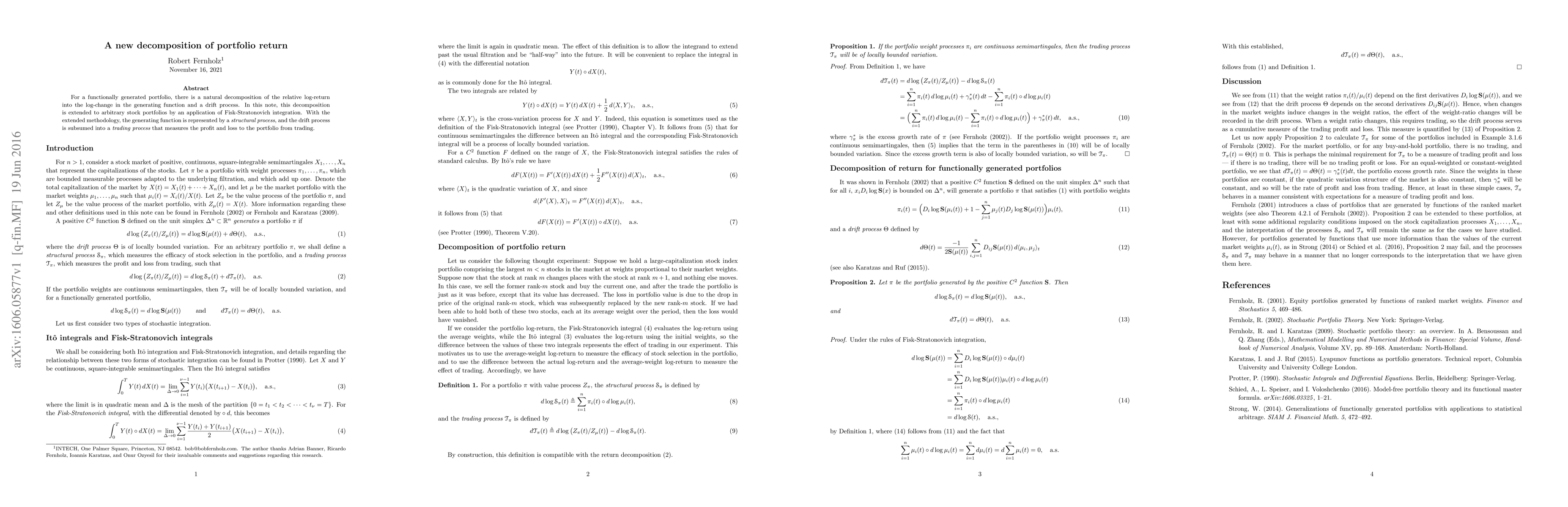

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA return-diversification approach to portfolio selection

Francesco Cesarone, Manuel Luis Martino, Rosella Giacometti et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)