Summary

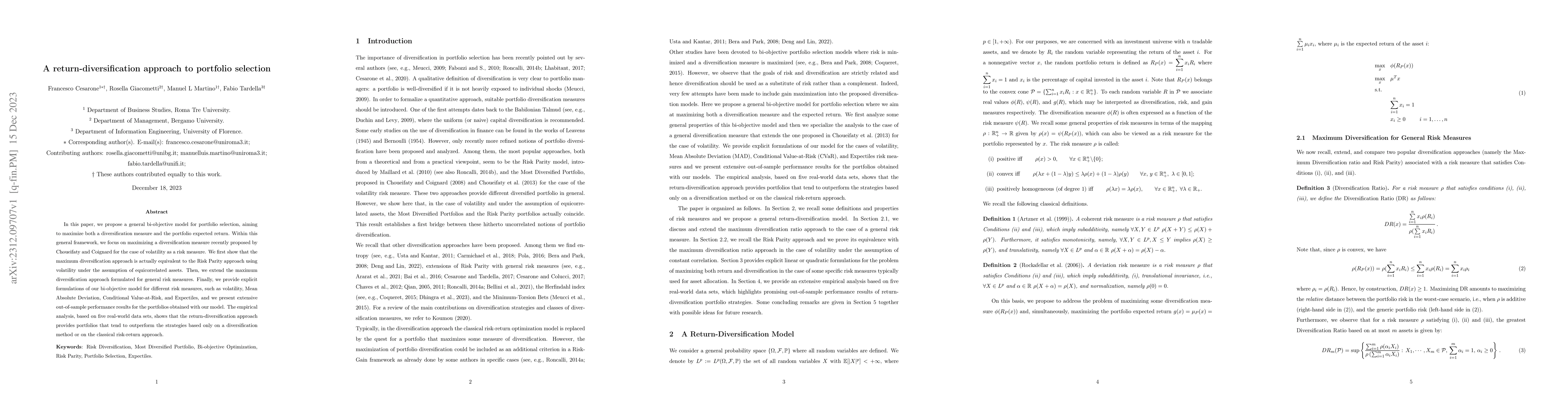

In this paper, we propose a general bi-objective model for portfolio selection, aiming to maximize both a diversification measure and the portfolio expected return. Within this general framework, we focus on maximizing a diversification measure recently proposed by Choueifaty and Coignard for the case of volatility as a risk measure. We first show that the maximum diversification approach is actually equivalent to the Risk Parity approach using volatility under the assumption of equicorrelated assets. Then, we extend the maximum diversification approach formulated for general risk measures. Finally, we provide explicit formulations of our bi-objective model for different risk measures, such as volatility, Mean Absolute Deviation, Conditional Value-at-Risk, and Expectiles, and we present extensive out-of-sample performance results for the portfolios obtained with our model. The empirical analysis, based on five real-world data sets, shows that the return-diversification approach provides portfolios that tend to outperform the strategies based only on a diversification method or on the classical risk-return approach.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMulti-Hypothesis Prediction for Portfolio Optimization: A Structured Ensemble Learning Approach to Risk Diversification

Xia Hong, Muhammad Shahzad, Alejandro Rodriguez Dominguez

| Title | Authors | Year | Actions |

|---|

Comments (0)