Authors

Summary

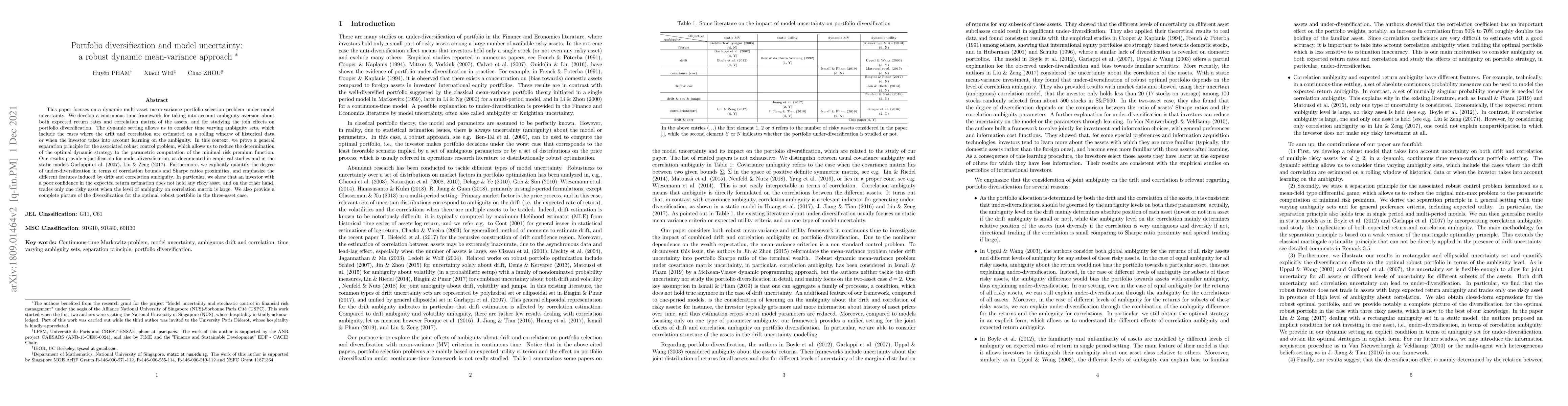

This paper focuses on a dynamic multi-asset mean-variance portfolio selection problem under model uncertainty. We develop a continuous time framework for taking into account ambiguity aversion about both expected return rates and correlation matrix of the assets, and for studying the join effects on portfolio diversification. The dynamic setting allows us to consider time varying ambiguity sets, which include the cases where the drift and correlation are estimated on a rolling window of historical data or when the investor takes into account learning on the ambiguity. In this context, we prove a general separation principle for the associated robust control problem, which allows us to reduce the determination of the optimal dynamic strategy to the parametric computation of the minimal risk premium function. Our results provide a justification for under-diversification, as documented in empirical studies and in the static models [16], [34]. Furthermore, we explicitly quantify the degree of under-diversification in termsof correlation bounds and Sharpe ratios proximities, and emphasize the different features induced by drift and correlation ambiguity. In particular, we show that an investor with a poor confidence in the expected return estimation does not hold any risky asset, and on the other hand, trades only one risky asset when the level of ambiguity on correlation matrix is large. We also provide a complete picture of the diversification for the optimal robust portfolio in the three-asset case JEL Classification: G11, C61 MSC Classification: 91G10, 91G80, 60H30

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersRobust equilibrium strategy for mean-variance-skewness portfolio selection problem

Zhihao Hu, Nan-jing Huang, Jian-hao Kang et al.

Dynamic Factor Model-Based Multiperiod Mean-Variance Portfolio Selection with Portfolio Constraints

Jianjun Gao, Yun Shi, Xiangyu Cui et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)