Authors

Summary

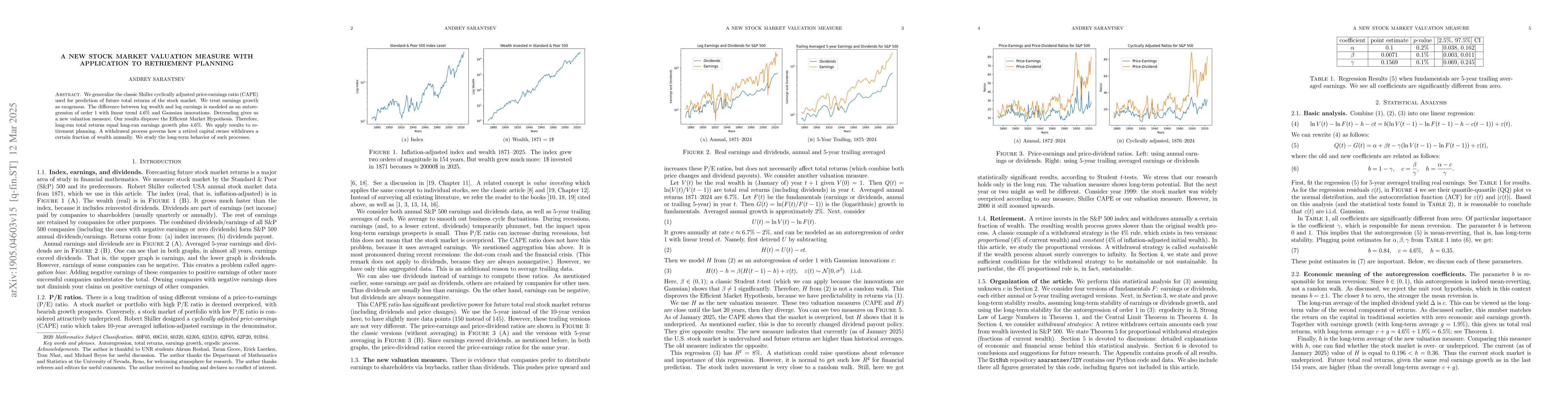

We generalize the classic Shiller cyclically adjusted price-earnings ratio (CAPE) used for prediction of future total returns of the stock market. We treat earnings growth as exogenous. The difference between log wealth and log earnings is modeled as an autoregression of order 1 with linear trend 4.5\% and Gaussian innovations. Detrending gives us a new valuation measure. This autoregression is significantly different from the random walk. Therefore, our results disprove the Efficient Market Hypothesis. Therefore, long-run total returns equal long-run earnings growth plus 4.5\%. We apply results to retirement planning. A withdrawal process governs how a retired capital owner withdraws a certain fraction of wealth annually. The fraction can vary from year to year. We study the long-term behavior of such processes.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)