Andrey Sarantsev

12 papers on arXiv

Academic Profile

Statistics

Similar Authors

Papers on arXiv

The Variance-Gamma Distribution: A Review

The variance-gamma (VG) distributions form a four-parameter family which includes as special and limiting cases the normal, gamma and Laplace distributions. Some of the numerous applications include...

Boundary Approximation for Sticky Jump-Reflected Processes on the Half-Line

The Skorokhod reflection was used in 1961 to create a reflected diffusion on the half-line. Later, it was used for processes with jumps such as reflected L\'evy processes. Like a Brownian motion, wh...

Modified Method of Moments for Generalized Laplace Distribution

In this note, we consider the performance of the classic method of moments for parameter estimation of symmetric variance-gamma (generalized Laplace) distributions. We do this through both theoretic...

Birth and Death Processes in Interactive Random Environments

This paper studies birth and death processes in interactive random environments where the birth and death rates and the dynamics of the state of the environment are dependent on each other. Two mode...

IID Time Series Testing

Traditional white noise testing, for example the Ljung-Box test, studies only the autocorrelation function (ACF). Time series can be heteroscedastic and therefore not i.i.d. but still white noise (t...

A New Stock Market Valuation Measure with Applications to Retirement Planning

We generalize the classic Shiller cyclically adjusted price-earnings ratio (CAPE) used for prediction of future total returns of the stock market. We treat earnings growth as exogenous. The differen...

Capital Asset Pricing Model with Size Factor and Normalizing by Volatility Index

The Capital Asset Pricing Model (CAPM) relates a well-diversified stock portfolio to a benchmark portfolio. We insert size effect in CAPM, capturing the observation that small stocks have higher risk ...

Tutorial on running median subtraction filter with application to searches for exotic field transients in multi-messenger astronomy

Running Median Subtraction Filter (RMSF) is a robust statistical tool for removing slowly varying baselines in data streams containing transients (short-duration signals) of interest. In this work, we...

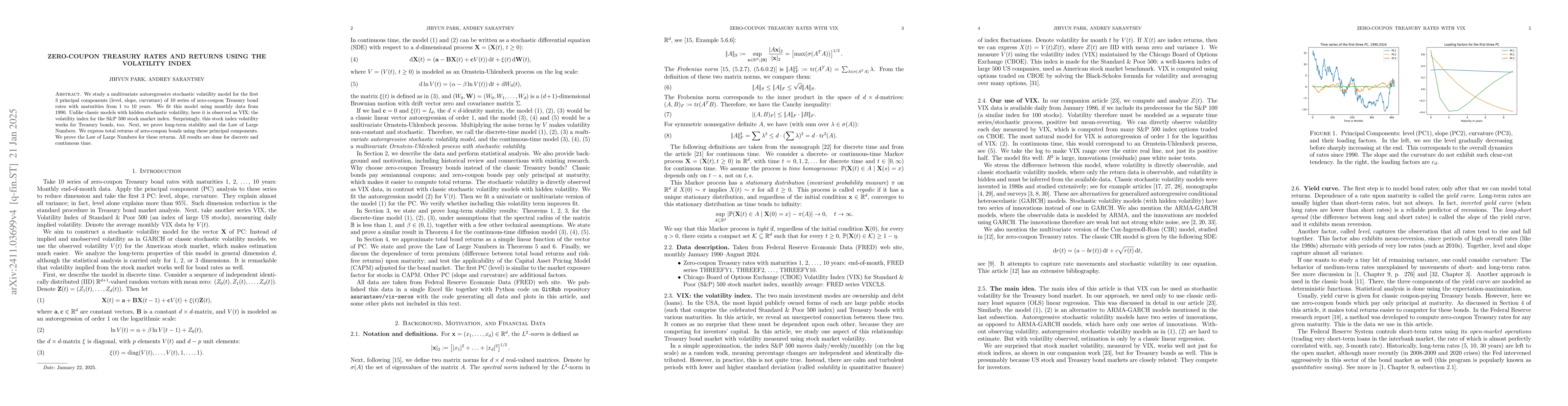

Zero-Coupon Treasury Yield Curve with VIX as Stochastic Volatility

We study a multivariate autoregressive stochastic volatility model for the first 3 principal components (level, slope, curvature) of 10 series of zero-coupon Treasury bond rates with maturities from 1...

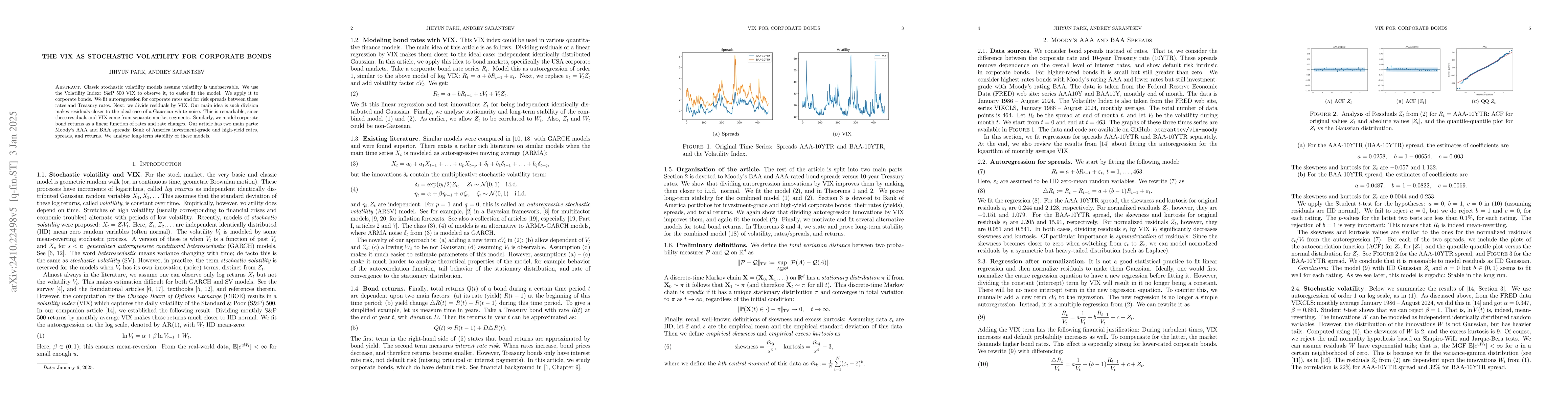

The VIX as Stochastic Volatility for Corporate Bonds

Classic stochastic volatility models assume volatility is unobservable. We use the Volatility Index: S\&P 500 VIX to observe it, to easier fit the model. We apply it to corporate bonds. We fit autoreg...

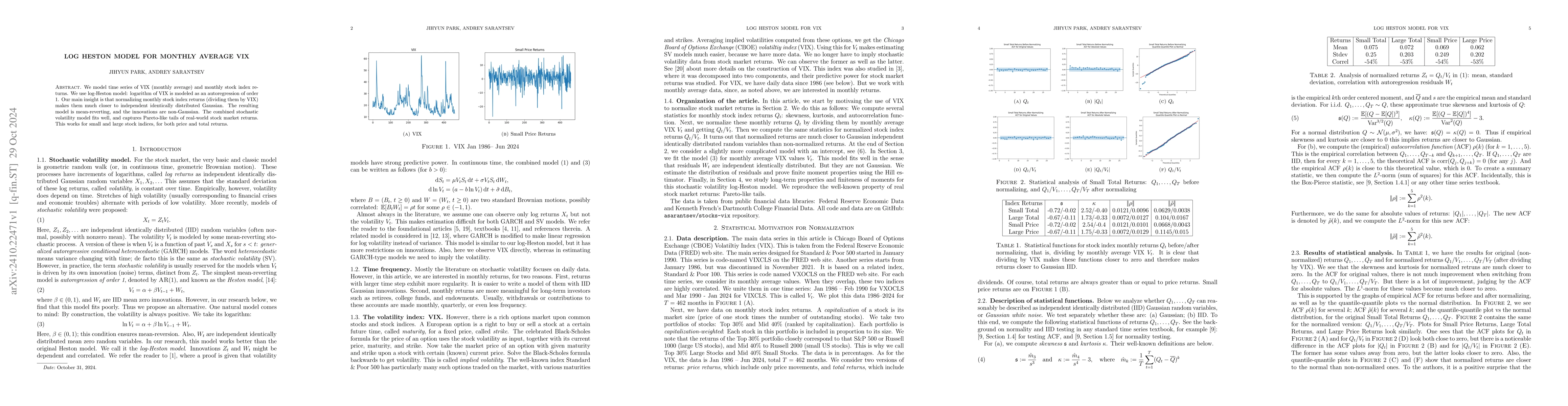

Log Heston Model for Monthly Average VIX

We model time series of VIX (monthly average) and monthly stock index returns. We use log-Heston model: logarithm of VIX is modeled as an autoregression of order 1. Our main insight is that normalizin...

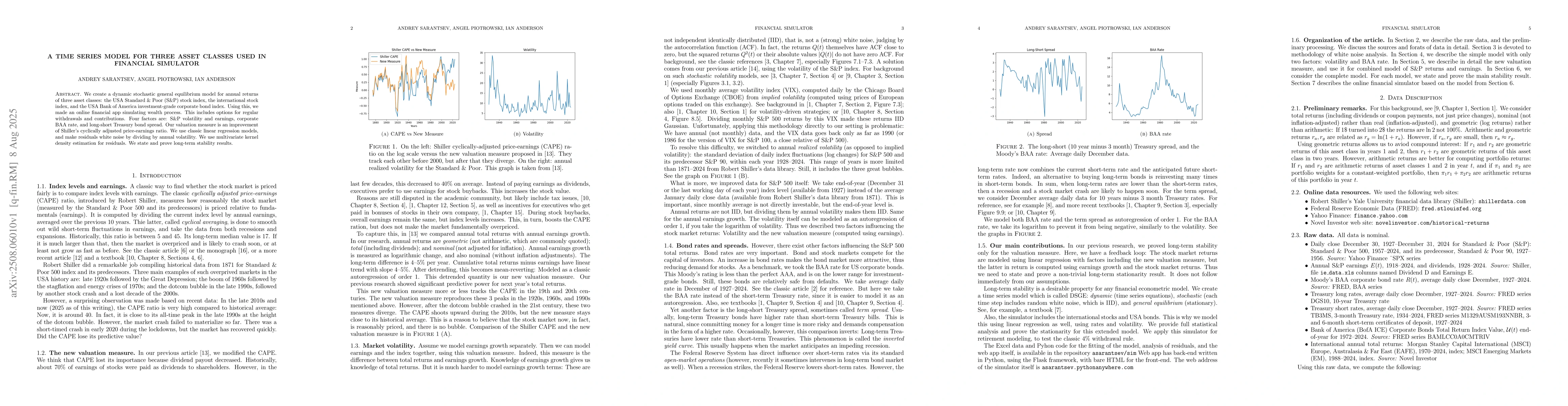

A Time Series Model for Three Asset Classes used in Financial Simulator

We create a dynamic stochastic general equilibrium model for annual returns of three asset classes: the USA Standard & Poor (S&P) stock index, the international stock index, and the USA Bank of Americ...