Authors

Summary

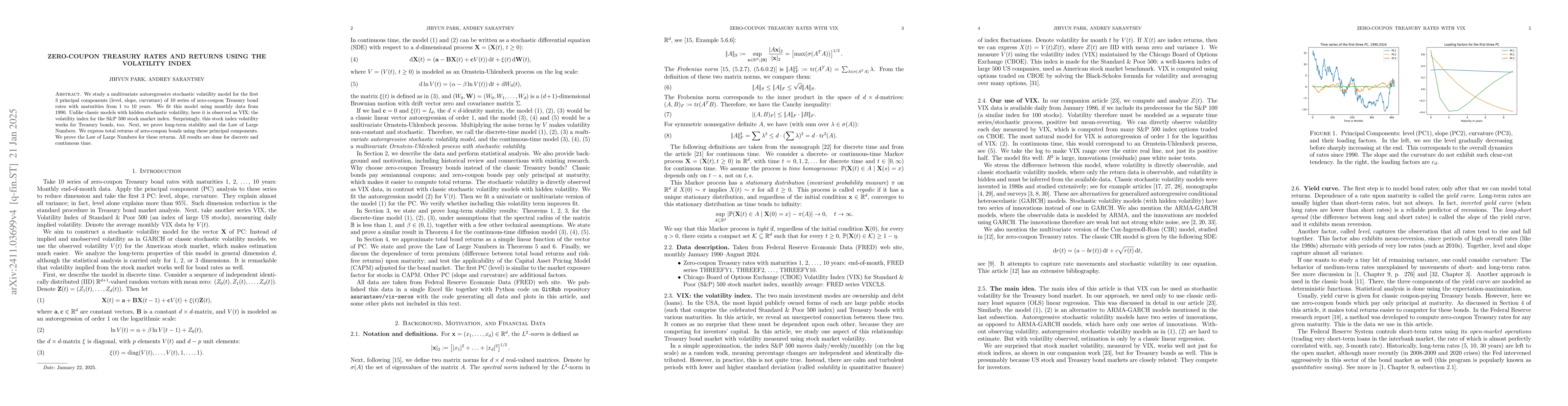

We study a multivariate autoregressive stochastic volatility model for the first 3 principal components (level, slope, curvature) of 10 series of zero-coupon Treasury bond rates with maturities from 1 to 10 years. We fit this model using monthly data from 1990. Next, we prove long-term stability for this discrete-time model and its continuous-time version. Unlike classic models with hidden stochastic volatility, here it is observed as VIX: the volatility index for the S\&P 500 stock market index. It is surprising that this volatility, created for the stock market, also works for Treasury bonds. Since total returns of zero-coupon bonds can be easily found from these principal components, we prove long-term stability for total returns in discrete time.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Similar Papers

Found 4 papersThe VIX as Stochastic Volatility for Corporate Bonds

Andrey Sarantsev, Jihyun Park

Pricing VIX options under the Heston-Hawkes stochastic volatility model

Oriol Zamora Font

No citations found for this paper.

Comments (0)