Authors

Summary

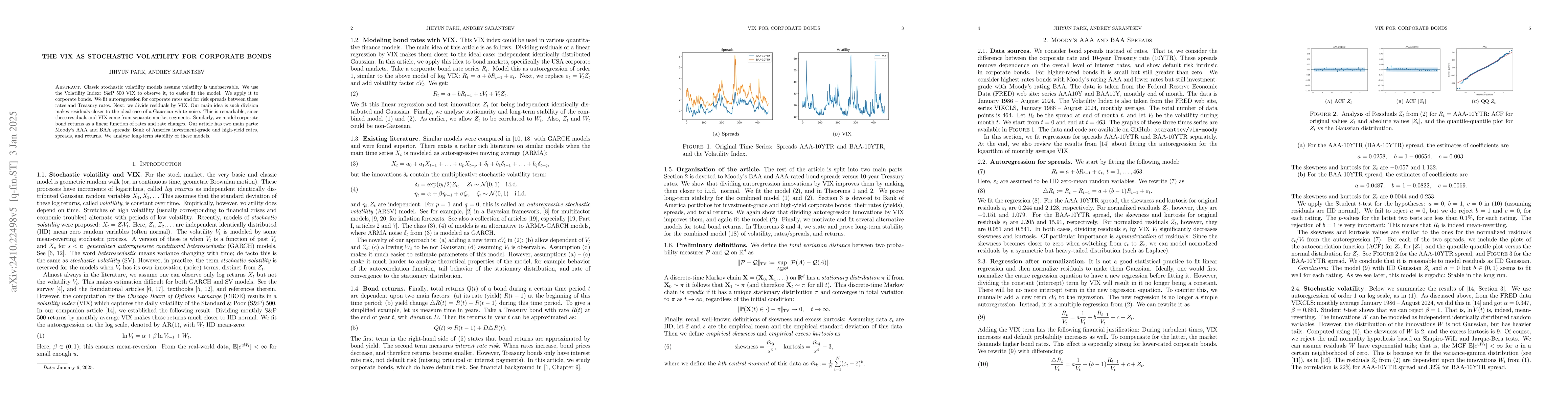

Classic stochastic volatility models assume volatility is unobservable. We use the Volatility Index: S\&P 500 VIX to observe it, to easier fit the model. We apply it to corporate bonds. We fit autoregression for corporate rates and for risk spreads between these rates and Treasury rates. Next, we divide residuals by VIX. Our main idea is such division makes residuals closer to the ideal case of a Gaussian white noise. This is remarkable, since these residuals and VIX come from separate market segments. Similarly, we model corporate bond returns as a linear function of rates and rate changes. Our article has two main parts: Moody's AAA and BAA spreads; Bank of America investment-grade and high-yield rates, spreads, and returns. We analyze long-term stability of these models.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersZero-Coupon Treasury Yield Curve with VIX as Stochastic Volatility

Andrey Sarantsev, Jihyun Park

Pricing VIX options under the Heston-Hawkes stochastic volatility model

Oriol Zamora Font

No citations found for this paper.

Comments (0)