Jihyun Park

5 papers on arXiv

Academic Profile

Statistics

Similar Authors

Papers on arXiv

Zero-Coupon Treasury Yield Curve with VIX as Stochastic Volatility

We study a multivariate autoregressive stochastic volatility model for the first 3 principal components (level, slope, curvature) of 10 series of zero-coupon Treasury bond rates with maturities from 1...

The VIX as Stochastic Volatility for Corporate Bonds

Classic stochastic volatility models assume volatility is unobservable. We use the Volatility Index: S\&P 500 VIX to observe it, to easier fit the model. We apply it to corporate bonds. We fit autoreg...

Log Heston Model for Monthly Average VIX

We model time series of VIX (monthly average) and monthly stock index returns. We use log-Heston model: logarithm of VIX is modeled as an autoregression of order 1. Our main insight is that normalizin...

KFinEval-Pilot: A Comprehensive Benchmark Suite for Korean Financial Language Understanding

We introduce KFinEval-Pilot, a benchmark suite specifically designed to evaluate large language models (LLMs) in the Korean financial domain. Addressing the limitations of existing English-centric ben...

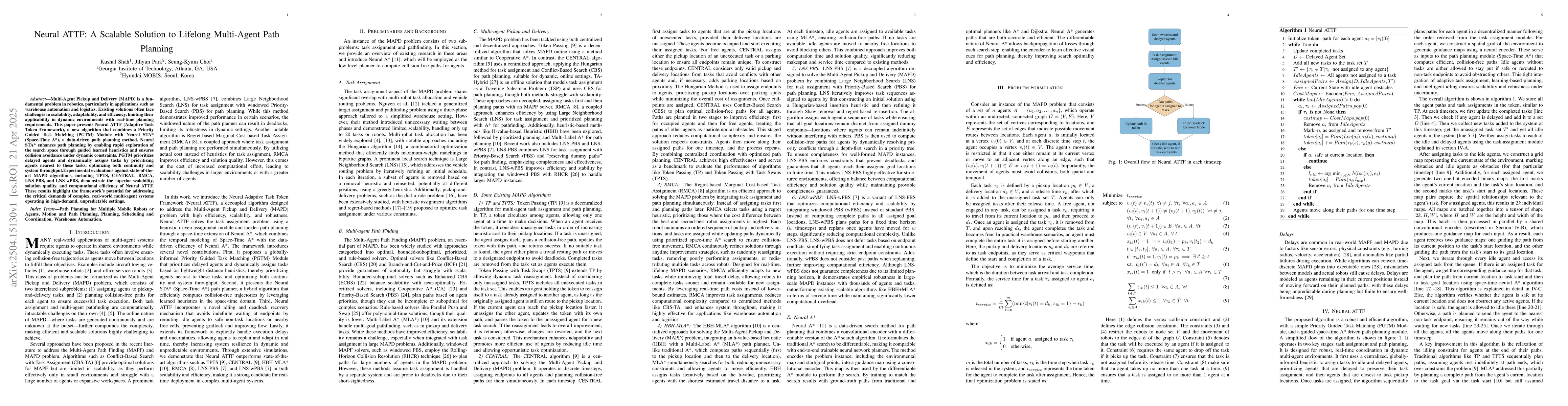

Neural ATTF: A Scalable Solution to Lifelong Multi-Agent Path Planning

Multi-Agent Pickup and Delivery (MAPD) is a fundamental problem in robotics, particularly in applications such as warehouse automation and logistics. Existing solutions often face challenges in scalab...