Authors

Summary

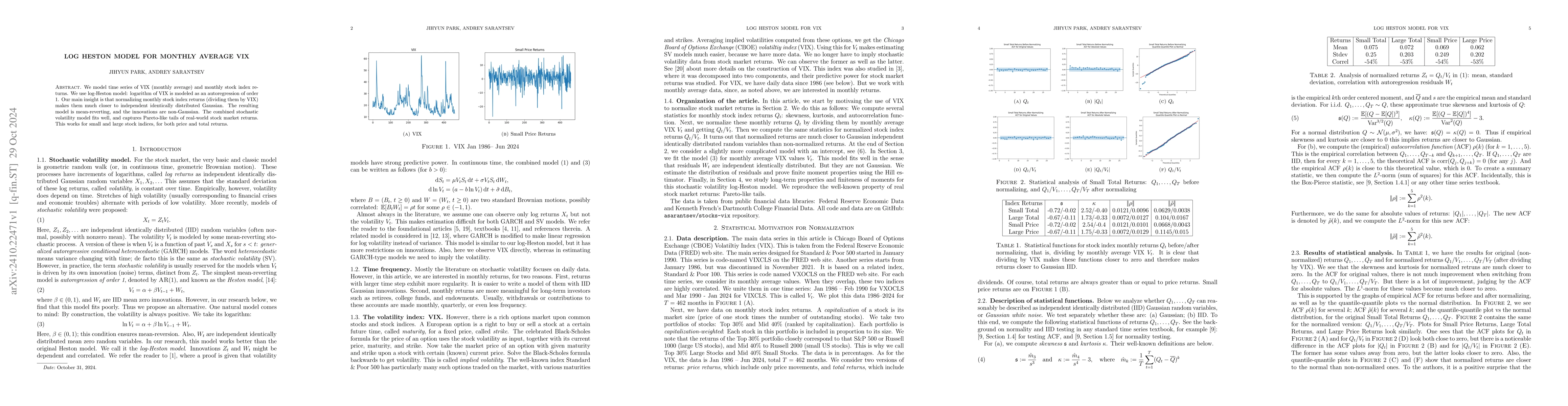

We model time series of VIX (monthly average) and monthly stock index returns. We use log-Heston model: logarithm of VIX is modeled as an autoregression of order 1. Our main insight is that normalizing monthly stock index returns (dividing them by VIX) makes them much closer to independent identically distributed Gaussian. The resulting model is mean-reverting, and the innovations are non-Gaussian. The combined stochastic volatility model fits well, and captures Pareto-like tails of real-world stock market returns. This works for small and large stock indices, for both price and total returns.

AI Key Findings

Generated Sep 02, 2025

Methodology

The research uses the log-Heston model to analyze time series of VIX (monthly average) and monthly stock index returns, employing an autoregressive model of order 1 for the logarithm of VIX. The study normalizes monthly stock index returns by dividing them with VIX to make them closer to independent identically distributed Gaussian variables.

Key Results

- The normalized stock returns are closer to Gaussian IID, making the model mean-reverting with non-Gaussian innovations.

- The combined stochastic volatility model fits well, capturing Pareto-like tails of real-world stock market returns for both small and large stock indices, whether using price or total returns.

- The statistical analysis shows that lnV (volatility) is well-modeled by mean-reverting autoregression of order 1, with residuals having exponential-like tails.

Significance

This research is significant as it proposes a log-Heston model that fits actual financial data well, exhibiting good long-term properties such as stationarity and mean-reversion. It captures the well-known property of real-world stock index returns: Pareto-like tails, which is crucial for accurate financial modeling.

Technical Contribution

The paper introduces a novel approach to modeling monthly average VIX and stock index returns using the log-Heston model, normalizing stock returns by VIX to achieve Gaussian-like behavior and capturing heavy-tailed innovations with a variance-gamma distribution.

Novelty

This work stands out by combining the log-Heston model with normalization by VIX to improve the Gaussian approximation of stock returns, and by employing a variance-gamma distribution to model the innovations, capturing the heavy tails observed in real-world financial data.

Limitations

- The paper does not explicitly discuss specific limitations in the methodology or assumptions.

- The analysis focuses on monthly data, which might not capture short-term dynamics.

Future Work

- Investigating bivariate distributions suitable for innovations (Zt, Wt) in the log-Heston model.

- Analyzing other stock indices, such as Value, Growth, or international indices.

- Exploring the applicability of the model to different time scales or more granular data (e.g., daily returns).

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersPricing VIX options under the Heston-Hawkes stochastic volatility model

Oriol Zamora Font

The rough Hawkes Heston stochastic volatility model

Alessandro Bondi, Sergio Pulido, Simone Scotti

| Title | Authors | Year | Actions |

|---|

Comments (0)