Summary

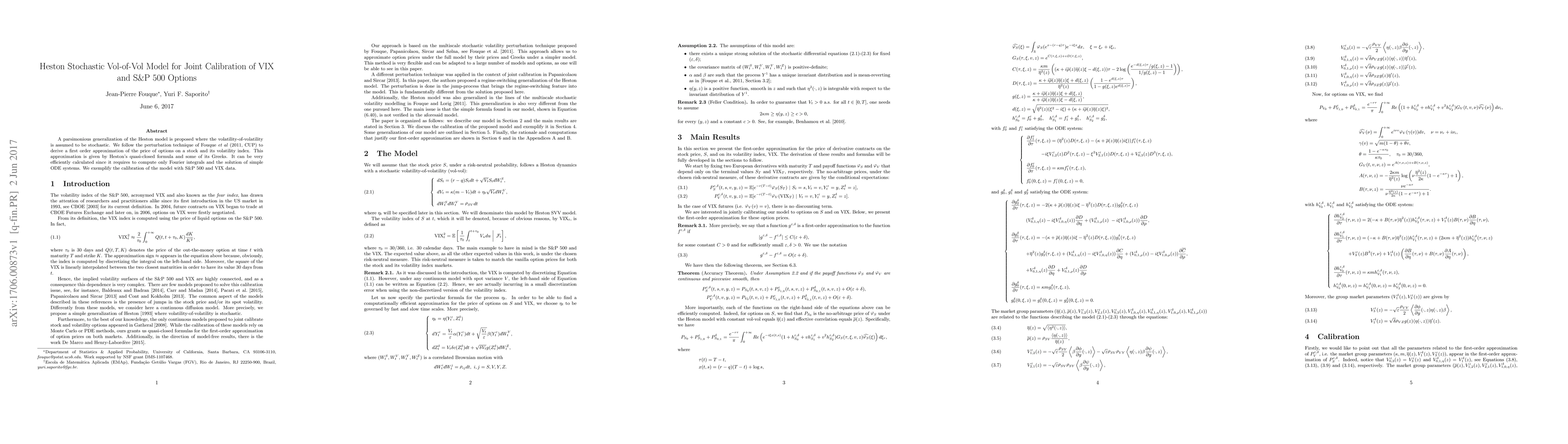

A parsimonious generalization of the Heston model is proposed where the volatility-of-volatility is assumed to be stochastic. We follow the perturbation technique of Fouque et al (2011, CUP) to derive a first order approximation of the price of options on a stock and its volatility index. This approximation is given by Heston's quasi-closed formula and some of its Greeks. It can be very efficiently calculated since it requires to compute only Fourier integrals and the solution of simple ODE systems. We exemplify the calibration of the model with S&P 500 and VIX data.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)