Summary

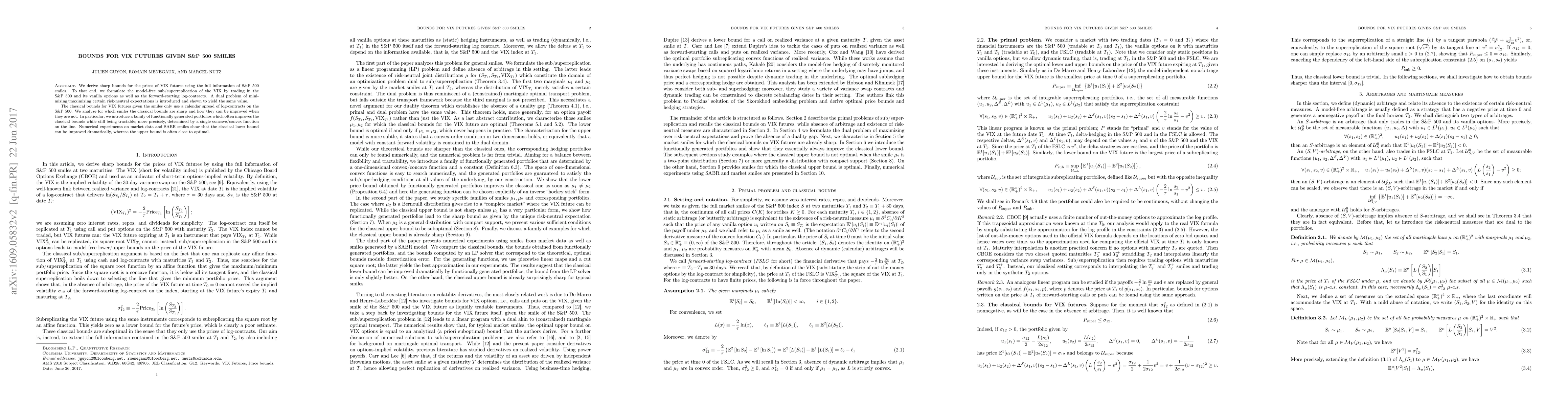

We derive sharp bounds for the prices of VIX futures using the full information of S&P 500 smiles. To that end, we formulate the model-free sub/superreplication of the VIX by trading in the S&P 500 and its vanilla options as well as the forward-starting log-contracts. A dual problem of minimizing/maximizing certain risk-neutral expectations is introduced and shown to yield the same value. The classical bounds for VIX futures given the smiles only use a calendar spread of log-contracts on the S&P 500. We analyze for which smiles the classical bounds are sharp and how they can be improved when they are not. In particular, we introduce a family of functionally generated portfolios which often improves the classical bounds while still being tractable; more precisely, determined by a single concave/convex function on the line. Numerical experiments on market data and SABR smiles show that the classical lower bound can be improved dramatically, whereas the upper bound is often close to optimal.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersThe Hybrid Forecast of S&P 500 Volatility ensembled from VIX, GARCH and LSTM models

Natalia Roszyk, Robert Ślepaczuk

| Title | Authors | Year | Actions |

|---|

Comments (0)