Authors

Summary

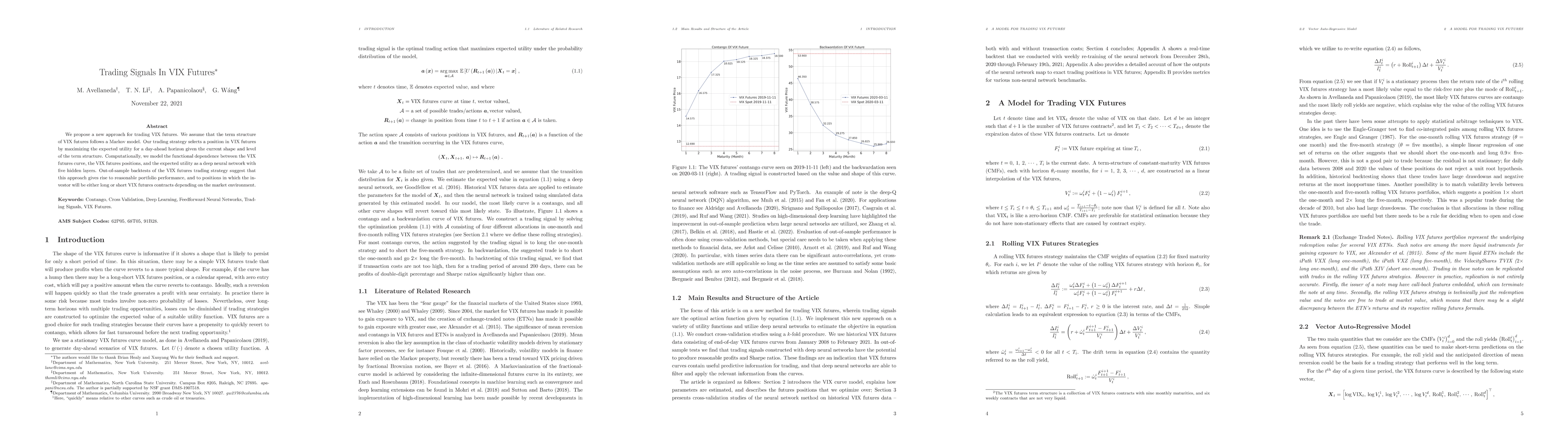

We propose a new approach for trading VIX futures. We assume that the term structure of VIX futures follows a Markov model. Our trading strategy selects a position in VIX futures by maximizing the expected utility for a day-ahead horizon given the current shape and level of the term structure. Computationally, we model the functional dependence between the VIX futures curve, the VIX futures positions, and the expected utility as a deep neural network with five hidden layers. Out-of-sample backtests of the VIX futures trading strategy suggest that this approach gives rise to reasonable portfolio performance, and to positions in which the investor will be either long or short VIX futures contracts depending on the market environment.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)