Summary

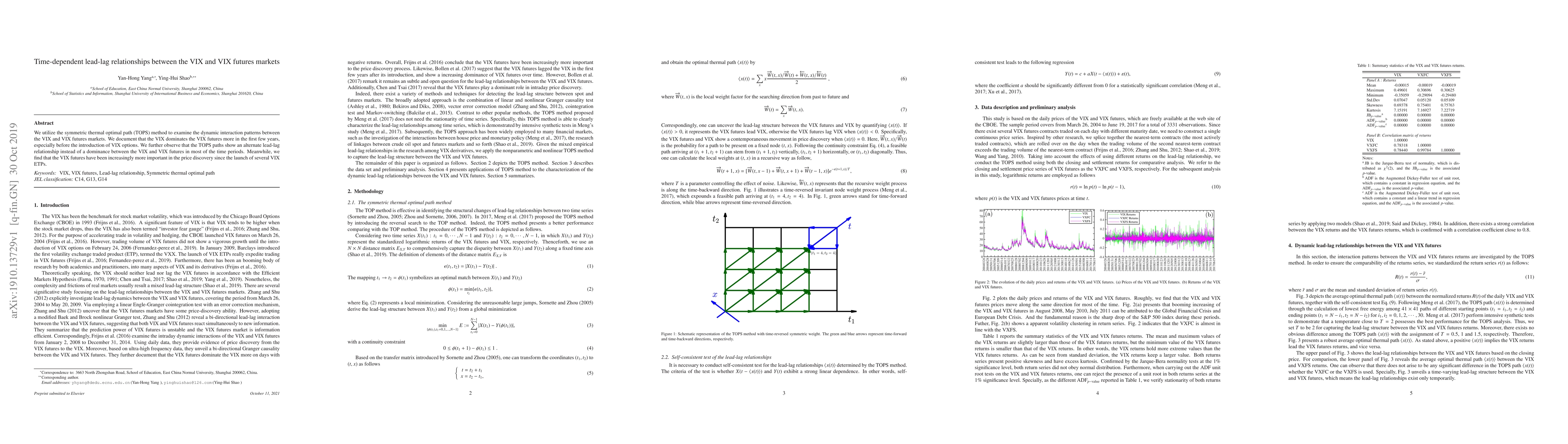

We utilize the symmetric thermal optimal path (TOPS) method to examine the dynamic interaction patterns between the VIX and VIX futures markets. We document that the VIX dominates the VIX futures more in the first few years, especially before the introduction of VIX options. We further observe that the TOPS paths show an alternate lead-lag relationship instead of a dominance between the VIX and VIX futures in most of the time periods. Meanwhile, we find that the VIX futures have been increasingly more important in the price discovery since the launch of several VIX ETPs.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)