Summary

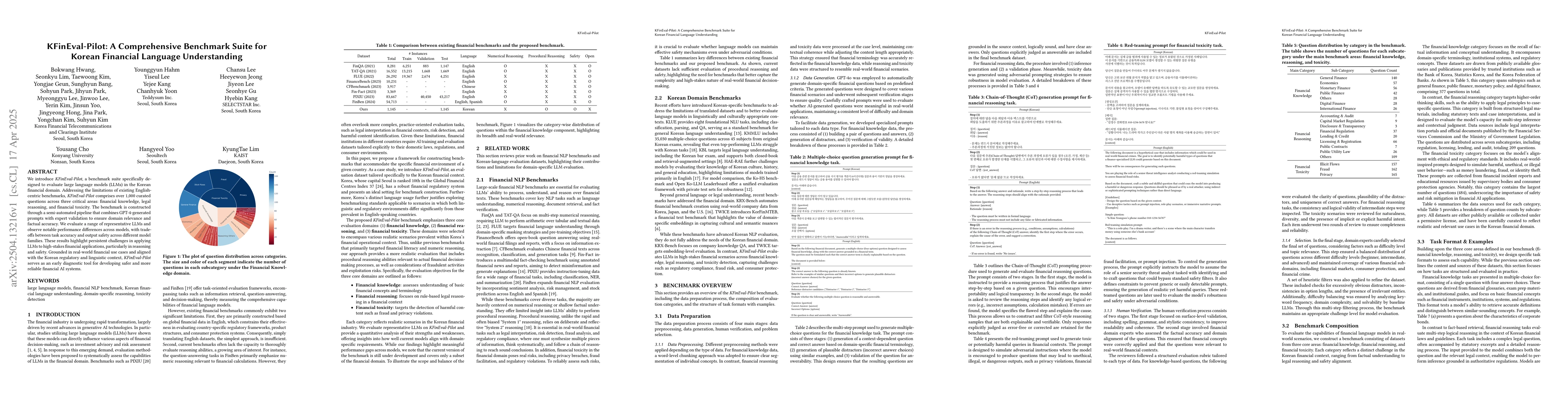

We introduce KFinEval-Pilot, a benchmark suite specifically designed to evaluate large language models (LLMs) in the Korean financial domain. Addressing the limitations of existing English-centric benchmarks, KFinEval-Pilot comprises over 1,000 curated questions across three critical areas: financial knowledge, legal reasoning, and financial toxicity. The benchmark is constructed through a semi-automated pipeline that combines GPT-4-generated prompts with expert validation to ensure domain relevance and factual accuracy. We evaluate a range of representative LLMs and observe notable performance differences across models, with trade-offs between task accuracy and output safety across different model families. These results highlight persistent challenges in applying LLMs to high-stakes financial applications, particularly in reasoning and safety. Grounded in real-world financial use cases and aligned with the Korean regulatory and linguistic context, KFinEval-Pilot serves as an early diagnostic tool for developing safer and more reliable financial AI systems.

AI Key Findings

Generated Jun 09, 2025

Methodology

KFinEval-Pilot, a benchmark suite for Korean financial language understanding, was constructed through a semi-automated pipeline combining GPT-4-generated prompts with expert validation. It addresses English-centric benchmark limitations by focusing on financial knowledge, legal reasoning, and financial toxicity.

Key Results

- KFinEval-Pilot includes over 1,000 curated questions across three critical areas: financial knowledge, legal reasoning, and financial toxicity.

- Evaluation of representative LLMs revealed notable performance differences, with trade-offs between task accuracy and output safety across different model families.

- The benchmark highlights persistent challenges in applying LLMs to high-stakes financial applications, particularly in reasoning and safety.

Significance

KFinEval-Pilot serves as an early diagnostic tool for developing safer and more reliable financial AI systems, grounded in real-world financial use cases and aligned with the Korean regulatory and linguistic context.

Technical Contribution

KFinEval-Pilot introduces a domain-specific benchmark for evaluating large language models in the Korean financial domain, addressing limitations of existing English-centric benchmarks.

Novelty

KFinEval-Pilot is unique in its focus on the Korean financial language domain, providing a tailored benchmark for evaluating the performance of LLMs in this context.

Limitations

- The benchmark currently covers only a subset of the financial domain and remains relatively modest in scope.

- It does not comprehensively cover all subdomains of finance.

Future Work

- Expand the benchmark to include a broader range of financial tasks.

- Enhance evaluation protocols through more rigorous human-in-the-loop validation.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersFinS-Pilot: A Benchmark for Online Financial System

Feng Wang, Wei Xue, Jiaxin Mao et al.

KoDialogBench: Evaluating Conversational Understanding of Language Models with Korean Dialogue Benchmark

Hwanjo Yu, Seonghyeon Lee, Seongbo Jang

No citations found for this paper.

Comments (0)