Authors

Summary

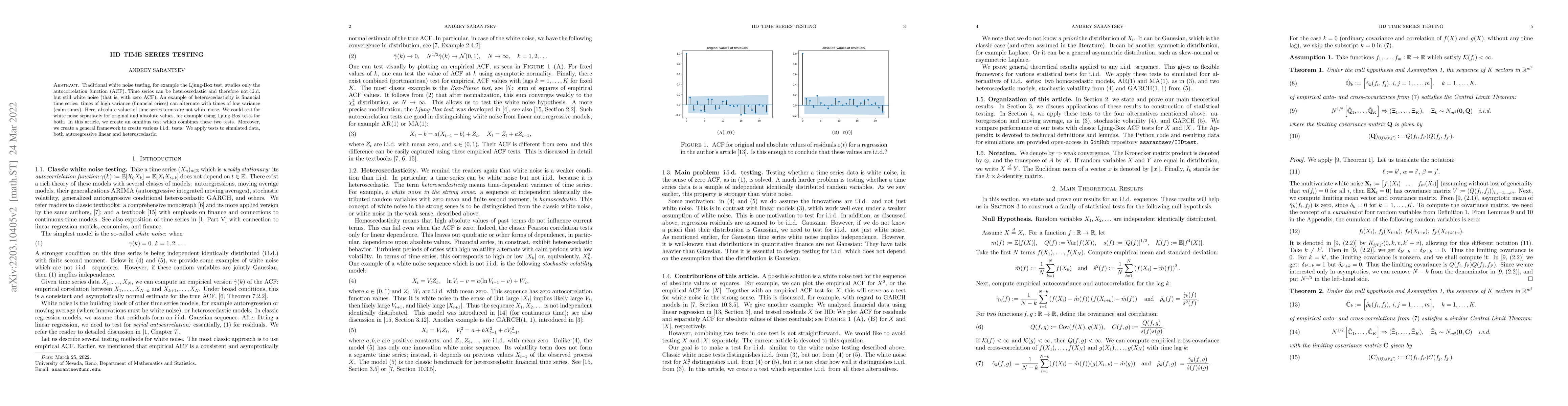

Traditional white noise testing, for example the Ljung-Box test, studies only the autocorrelation function (ACF). Time series can be heteroscedastic and therefore not i.i.d. but still white noise (that is, with zero ACF). An example of heteroscedasticity is financial time series: times of high variance (financial crises) can alternate with times of low variance (calm times). Here, absolute values of time series terms are not white noise. We could test for white noise separately for original and absolute values, for example using Ljung-Box tests for both. In this article, we create an omnibus test which combines these two tests. Moreover, we create a general framework to create various i.i.d. tests. We apply tests to simulated data, both autoregressive linear and heteroscedastic.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNon-iid hypothesis testing: from classical to quantum

Giacomo De Palma, Ryan O'Donnell, Marco Fanizza et al.

Testing for integer integration in functional time series

Won-Ki Seo, Han Lin Shang

Change-Point Testing for Risk Measures in Time Series

Peter W. Glynn, Lin Fan, Markus Pelger

No citations found for this paper.

Comments (0)