Authors

Summary

We propose novel methods for change-point testing for nonparametric estimators of expected shortfall and related risk measures in weakly dependent time series. We can detect general multiple structural changes in the tails of marginal distributions of time series under general assumptions. Self-normalization allows us to avoid the issues of standard error estimation. The theoretical foundations for our methods are functional central limit theorems, which we develop under weak assumptions. An empirical study of S&P 500 and US Treasury bond returns illustrates the practical use of our methods in detecting and quantifying market instability via the tails of financial time series.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

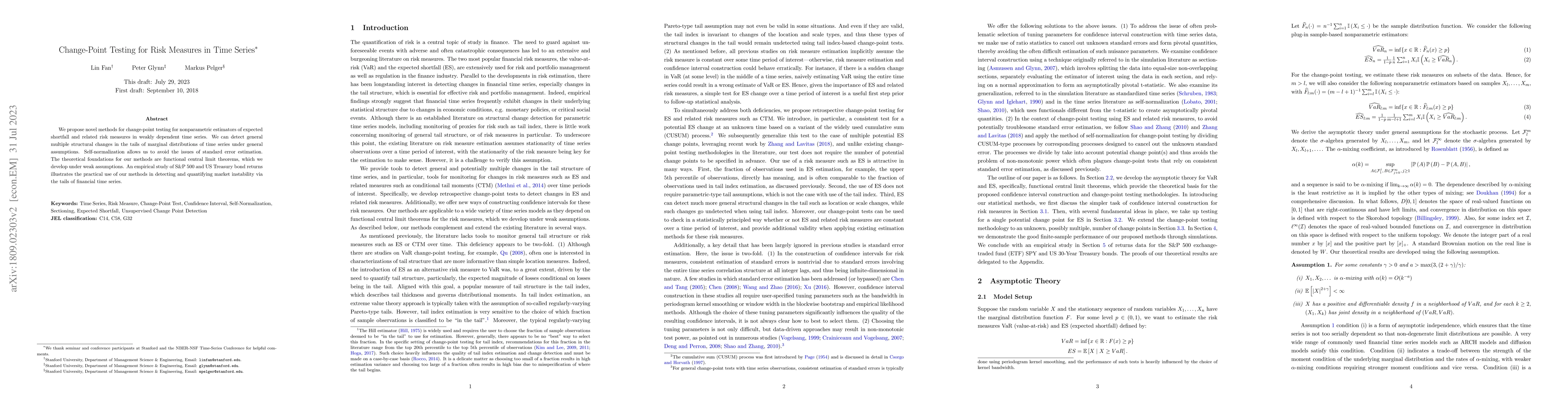

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersTwo-Sample and Change-Point Inference for Non-Euclidean Valued Time Series

Xiaofeng Shao, Feiyu Jiang, Changbo Zhu

No citations found for this paper.

Comments (0)