Authors

Summary

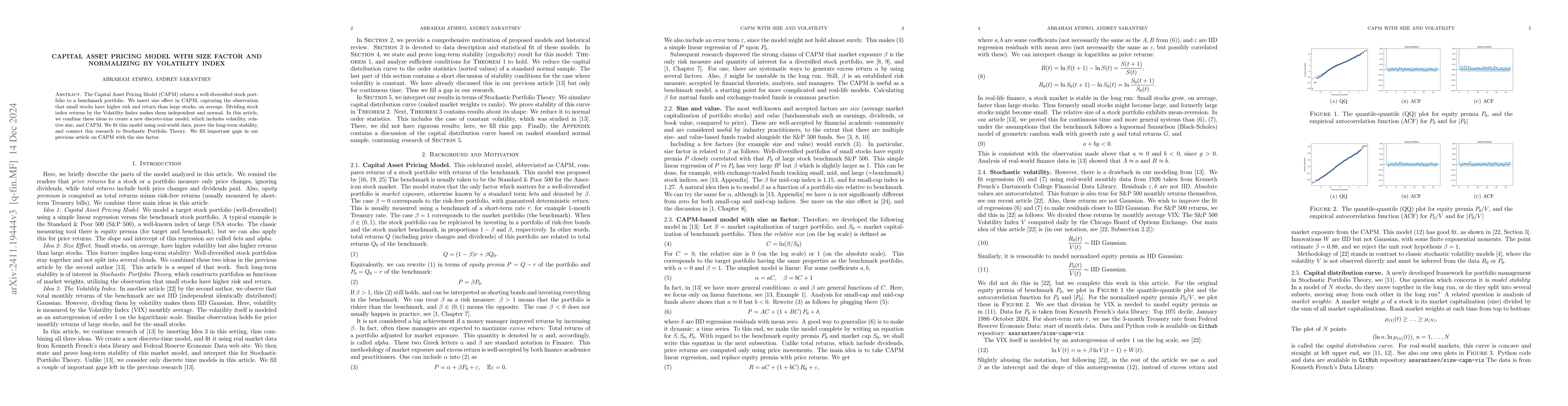

The Capital Asset Pricing Model (CAPM) relates a well-diversified stock portfolio to a benchmark portfolio. We insert size effect in CAPM, capturing the observation that small stocks have higher risk and return than large stocks, on average. Dividing stock index returns by the Volatility Index makes them independent and normal. In this article, we combine these ideas to create a new discrete-time model, which includes volatility, relative size, and CAPM. We fit this model using real-world data, prove the long-term stability, and connect this research to Stochastic Portfolio Theory.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)