Summary

We provide a critical analysis of the proof of the fundamental theorem of asset pricing given in the paper "Arbitrage and approximate arbitrage: the fundamental theorem of asset pricing" by B. Wong and C.C. Heyde (Stochastics, 2010) in the context of incomplete It\^o-process models. We show that their approach can only work in the known case of a complete financial market model and give an explicit counterexample.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

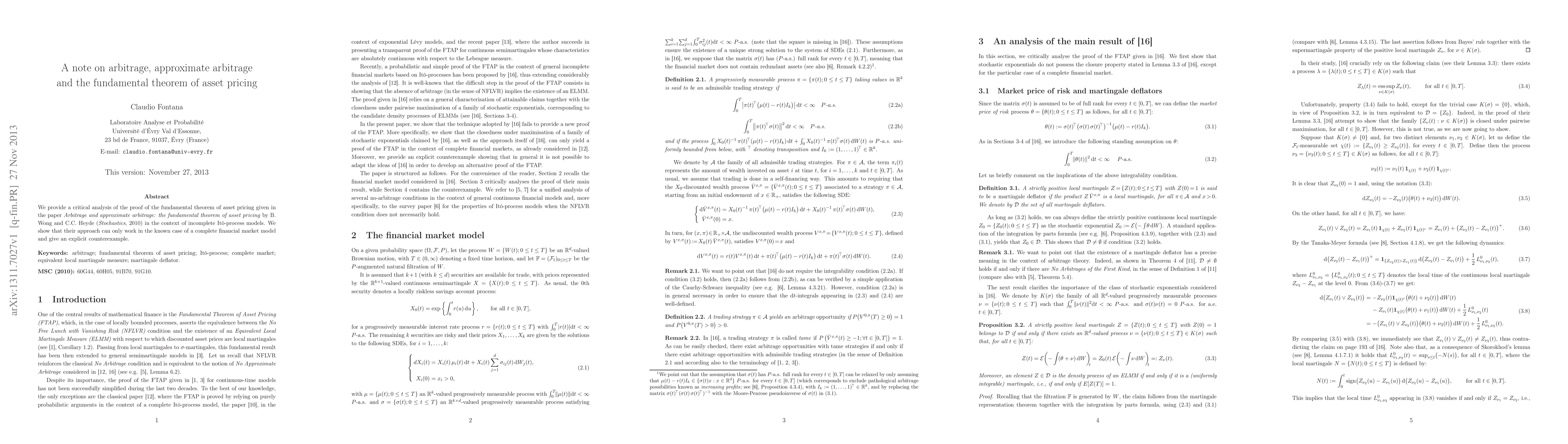

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersProspective strict no-arbitrage and the fundamental theorem of asset pricing under transaction costs

Quantitative Fundamental Theorem of Asset Pricing

Gudmund Pammer, Beatrice Acciaio, Julio Backhoff

| Title | Authors | Year | Actions |

|---|

Comments (0)