Summary

In discrete time markets with proportional transaction costs, Schachermayer (2004) shows that robust no-arbitrage is equivalent to the existence of a strictly consistent price system. In this paper, we introduce the concept of prospective strict no-arbitrage that is a variant of the strict no-arbitrage property from Kabanov, R\'asonyi, and Stricker (2002). The prospective strict no-arbitrage condition is slightly weaker than robust no-arbitrage, and it implies that the set of portfolios attainable from zero initial endowment is closed in probability. A weak version of prospective strict no-arbitrage turns out to be equivalent to the existence of a consistent price system. In contrast to the fundamental theorem of asset pricing of Schachermayer (2004), the consistent frictionless prices may lie on the boundary of the bid-ask spread. On the technical level, a crucial difference to Schachermayer (2004) and Kabanov-R\'asonyi-Stricker (2003) is that we prove closedness without having at hand that the null-strategies form a linear space.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

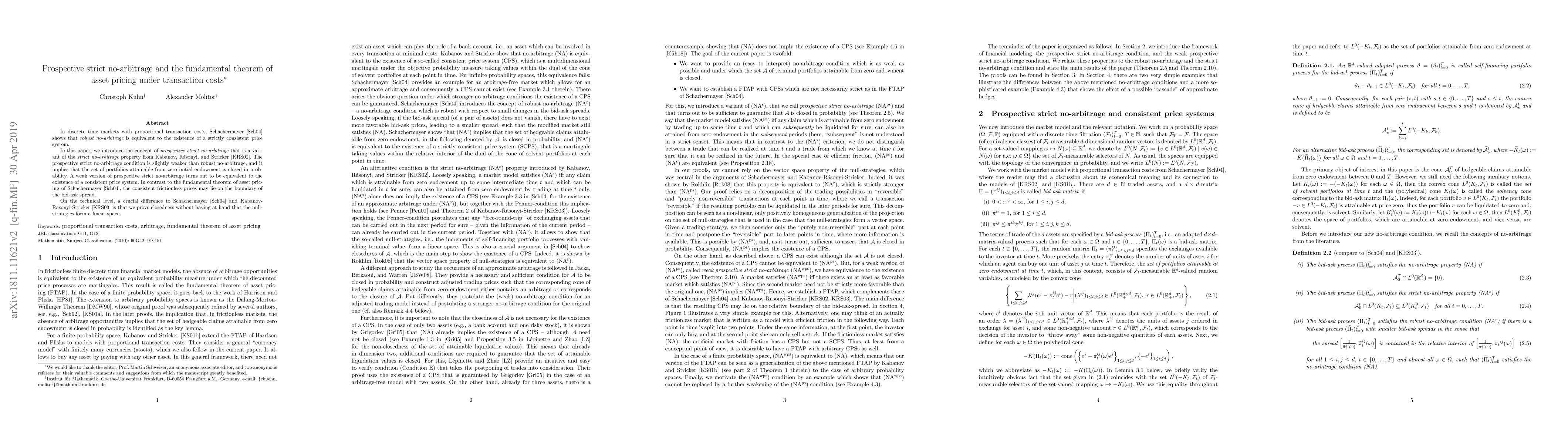

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)