Authors

Summary

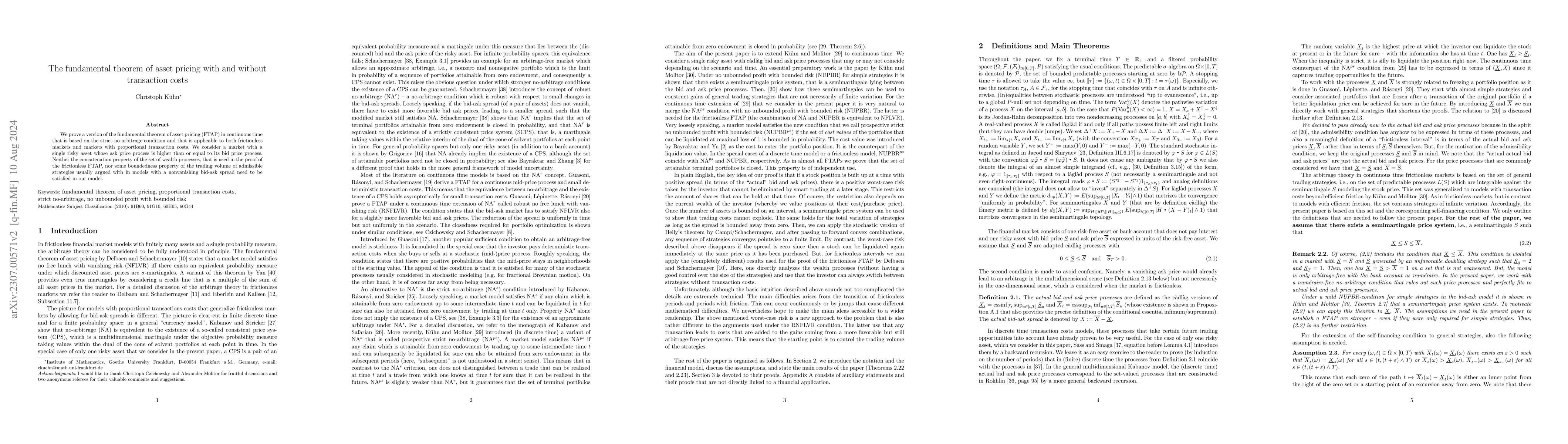

We prove a version of the fundamental theorem of asset pricing (FTAP) in continuous time that is based on the strict no-arbitrage condition and that is applicable to both frictionless markets and markets with proportional transaction costs. We consider a market with a single risky asset whose ask price process is higher than or equal to its bid price process. Neither the concatenation property of the set of wealth processes, that is used in the proof of the frictionless FTAP, nor some boundedness property of the trading volume of admissible strategies usually argued with in models with a nonvanishing bid-ask spread need to be satisfied in our model.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)