Summary

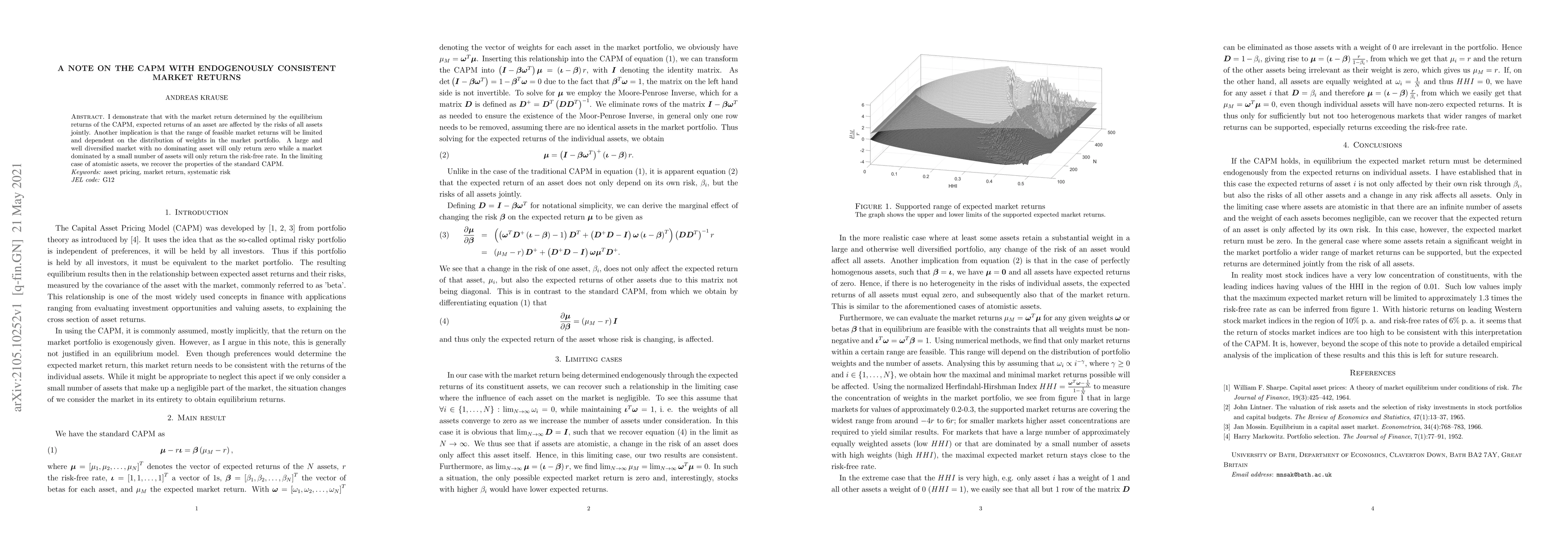

I demonstrate that with the market return determined by the equilibrium returns of the CAPM, expected returns of an asset are affected by the risks of all assets jointly. Another implication is that the range of feasible market returns will be limited and dependent on the distribution of weights in the market portfolio. A large and well diversified market with no dominating asset will only return zero while a market dominated by a small number of assets will only return the risk-free rate. In the limiting case of atomistic assets, we recover the properties of the standard CAPM.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)