Summary

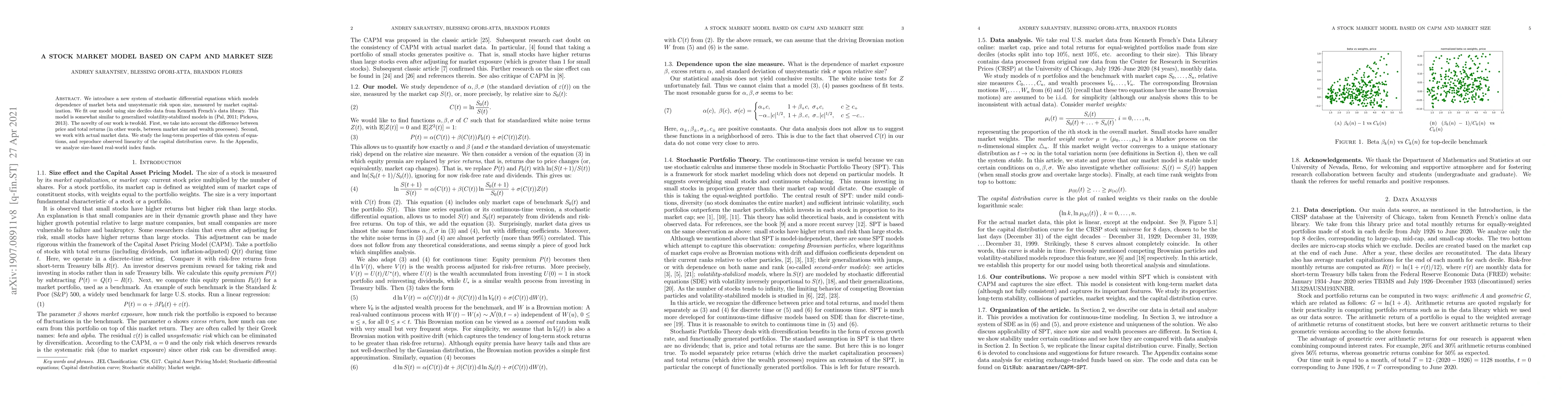

We introduce a new system of stochastic differential equations which models dependence of market beta and unsystematic risk upon size, measured by market capitalization. We fit our model using size deciles data from Kenneth French's data library. This model is somewhat similar to generalized volatility-stabilized models in (Pal, 2011; Pickova, 2013). The novelty of our work is twofold. First, we take into account the difference between price and total returns (in other words, between market size and wealth processes). Second, we work with actual market data. We study the long-term properties of this system of equations, and reproduce observed linearity of the capital distribution curve. Our model has two modifications: for price returns and for equity premium. Somewhat surprisingly, they exhibit the same fit, with very similar coefficients. In the Appendix, we analyze size-based real-world index funds.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)