Authors

Summary

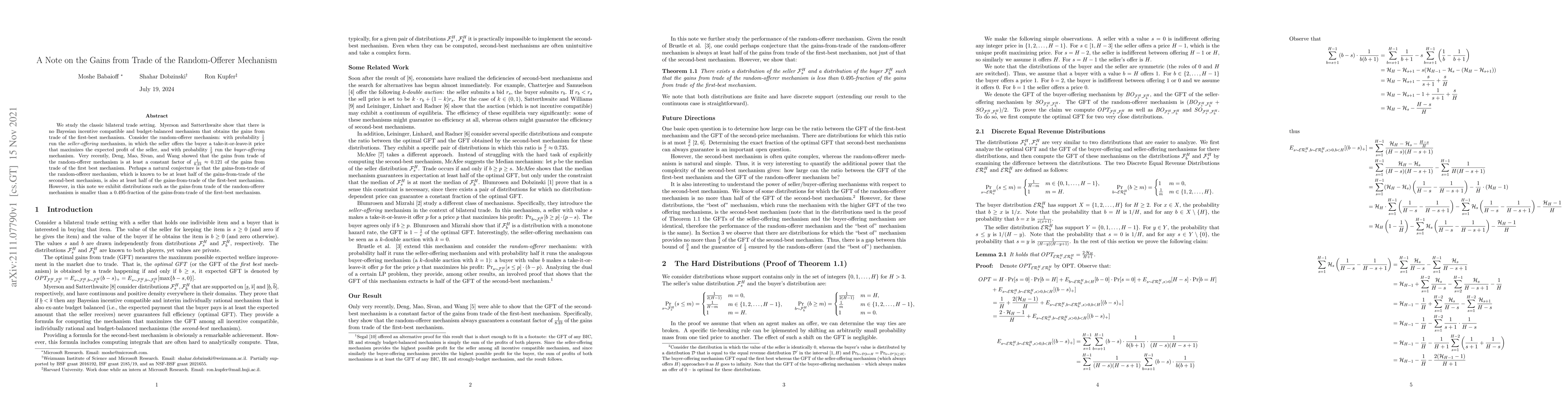

We study the classic bilateral trade setting. Myerson and Satterthwaite show that there is no Bayesian incentive compatible and budget-balanced mechanism that obtains the gains from trade of the first-best mechanism. Consider the random-offerer mechanism: with probability $\frac{1}{2}$ run the \emph{seller-offering} mechanism, in which the seller offers the buyer a take-it-or-leave-it price that maximizes the expected profit of the seller, and with probability $\frac{1}{2}$ run the \emph{buyer-offering} mechanism. Very recently, Deng, Mao, Sivan, and Wang showed that the gains from trade of the random-offerer mechanism is at least a constant factor of $\frac 1 {8.23}\approx 0.121$ of the gains from trade of the first best mechanism. Perhaps a natural conjecture is that the gains-from-trade of the random-offerer mechanism, which is known to be at least half of the gains-from-trade of the second-best mechanism, is also at least half of the gains-from-trade of the first-best mechanism. However, in this note we exhibit distributions such as the gains-from trade of the random-offerer mechanism is smaller than a $0.495$-fraction of the gains-from-trade of the first-best mechanism.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOn Multi-Dimensional Gains from Trade Maximization

Yang Cai, Mingfei Zhao, Kira Goldner et al.

Gains-from-Trade in Bilateral Trade with a Broker

MohammadTaghi Hajiaghayi, Suho Shin, Gary Peng et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)