Authors

Summary

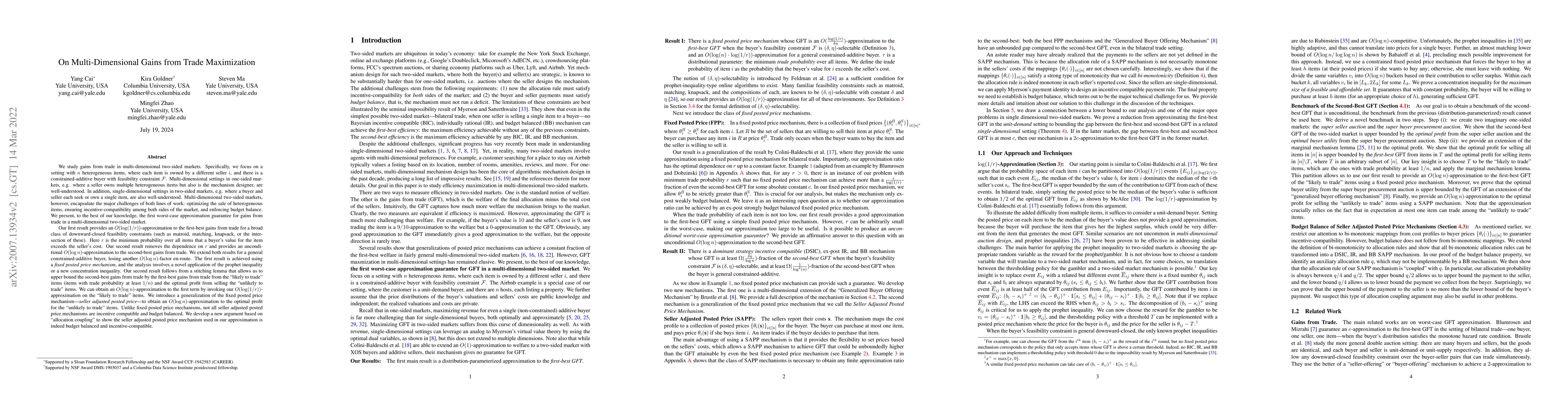

We study gains from trade in multi-dimensional two-sided markets. Specifically, we focus on a setting with $n$ heterogeneous items, where each item is owned by a different seller $i$, and there is a constrained-additive buyer with feasibility constraint $\mathcal{F}$. Multi-dimensional settings in one-sided markets, e.g. where a seller owns multiple heterogeneous items but also is the mechanism designer, are well-understood. In addition, single-dimensional settings in two-sided markets, e.g. where a buyer and seller each seek or own a single item, are also well-understood. Multi-dimensional two-sided markets, however, encapsulate the major challenges of both lines of work: optimizing the sale of heterogeneous items, ensuring incentive-compatibility among both sides of the market, and enforcing budget balance. We present, to the best of our knowledge, the first worst-case approximation guarantee for gains from trade in a multi-dimensional two-sided market. Our first result provides an $O(\log (1/r))$-approximation to the first-best gains from trade for a broad class of downward-closed feasibility constraints (such as matroid, matching, knapsack, or the intersection of these). Here $r$ is the minimum probability over all items that a buyer's value for the item exceeds the seller's cost. Our second result removes the dependence on $r$ and provides an unconditional $O(\log n)$-approximation to the second-best gains from trade. We extend both results for a general constrained-additive buyer, losing another $O(\log n)$-factor en-route.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersGains-from-Trade in Bilateral Trade with a Broker

MohammadTaghi Hajiaghayi, Suho Shin, Gary Peng et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)