Summary

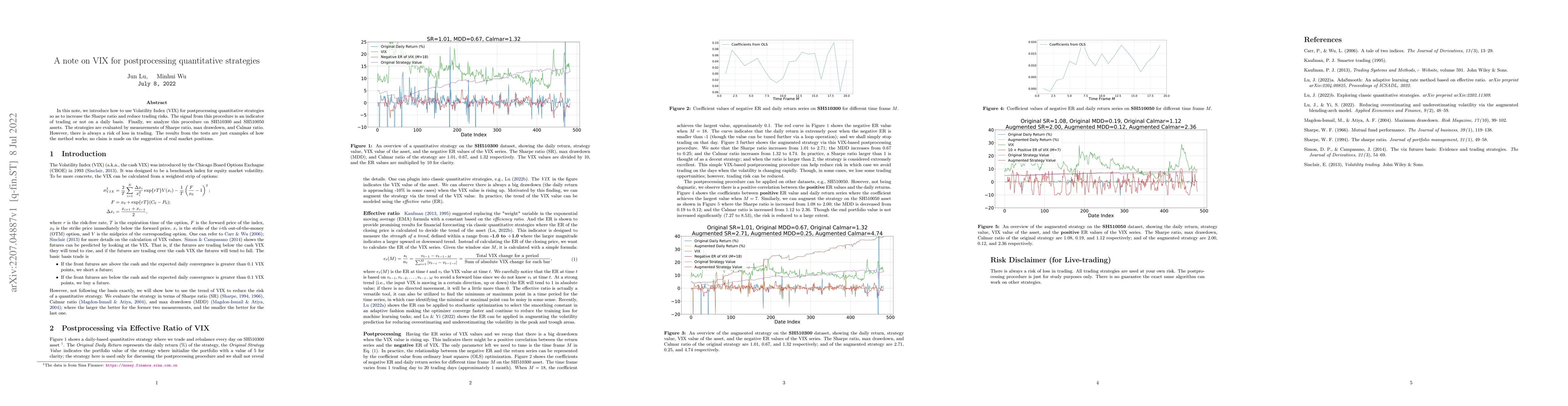

In this note, we introduce how to use Volatility Index (VIX) for postprocessing quantitative strategies so as to increase the Sharpe ratio and reduce trading risks. The signal from this procedure is an indicator of trading or not on a daily basis. Finally, we analyze this procedure on SH510300 and SH510050 assets. The strategies are evaluated by measurements of Sharpe ratio, max drawdown, and Calmar ratio. However, there is always a risk of loss in trading. The results from the tests are just examples of how the method works; no claim is made on the suggestion of real market positions.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersEfficient implementation of portfolio strategies involving cryptocurrencies and VIX INDEX and Gold

Jiahao Cui, Qiushi Li, Yuezhi Pen

No citations found for this paper.

Comments (0)